Account TaxCloud

Description

This App connects Odoo with TaxCloud, enabling automatic computation of sales tax on invoices within the Odoo platform.

This App is replacing the App that was previously supported by Odoo. See this link for an explanation.

Odoo released the code to TaxCloud and Sodexis is maintaining it. Bug fixing and new features will only be added to this module going forward. If you are already using the Odoo App and want to benefit from those bug fixing and new features, you can transition to this App, see the instructions below. Please make sure you test this transition before you do it in production.

If you are not currently using the Odoo connector, you can install this app as any other App.

For previous versions of Odoo (< V17) you will need to first migrate to V17 and then transition to this new App. If you need any help with the migration, contact Sodexis at info@sodexis.com, we have a full team of business analysts and developers that can help you.

If you have any questions about sales taxes, please feel free to reach out to the TaxCloud team here . If you're interested in learning how TaxCloud can automate your Odoo sales tax collection, find more information at https://taxcloud.com/integrations/odoo/ .

About TaxCloud:

TaxCloud (https://taxcloud.com/ ) is a sales tax compliance solution with over 15 years of experience in tax technology. Trusted by more than 4,000 companies, TaxCloud streamlines the management of sales taxes from collection and calculation to filing. It supports e-commerce businesses in navigating the complex U.S. tax regulations across all 50 states and over 13,000 jurisdictions. With TaxCloud, businesses can accurately calculate taxes, reduce the hassle of keeping up with changing tax laws, and ensure effortless compliance. Say goodbye to the stress and frustration of sales tax with TaxCloud.

Module Installation:

- If you are not using the Odoo App, you can install this App by clicking on the "Activate" button and then proceed with the configuration, see below.

- If you are using the Odoo TaxCloud App, do not uninstall it before installing our App, you will lose all your data. Install our App by clicking on the "Activate" button. Our module will take care of the transition of configuration and data from the existing App and uninstall the odoo TaxCloud App. Do not reinstall the Odoo Taxcloud App once you have switched to this new one.

For any technical questions or support contact us at 📧 taxcloud@sodexis.com . We will provide free support for the installation to the first few customers, so contact us if you want help.

Configuration

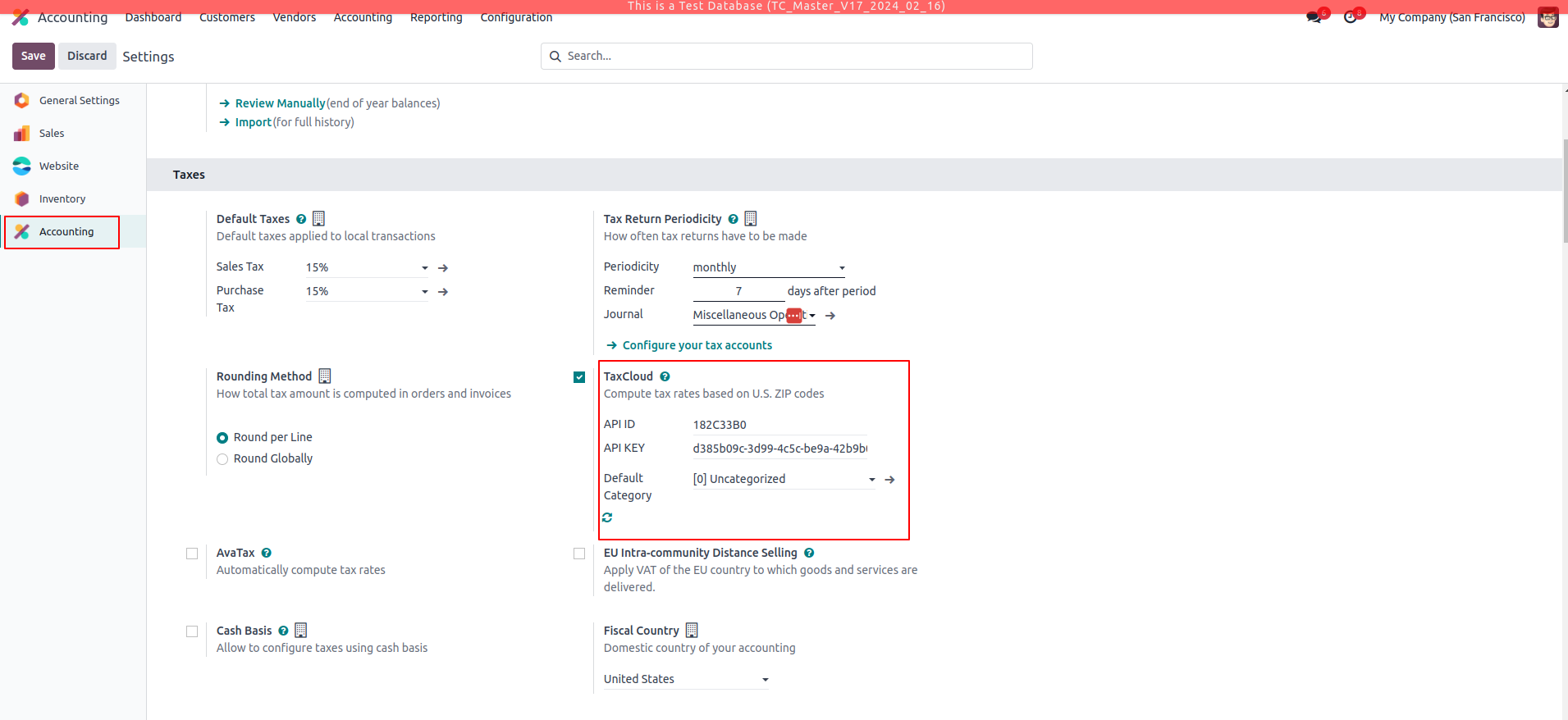

Go to Accounting - - > Configuration - - > Settings - - > Taxcloud.

API credentials from the Taxcloud site are entered into the fields under the TaxCloud section. These steps are required in order to integrate Odoo with Taxcloud.

The credentials include API ID, API Key and the Default Category.

- Refresh button at the bottom of Default Category is used to import the TIC (Taxability Information Codes) product categories from TaxCloud.

- The Default Category is applied when no TaxCloud Category is set on your products or product categories.

Discover more about keeping your business compliant with sales tax regulations:

- Explore TaxCloud Taxability Information Codes (TICs) for detailed product tax classifications: https://app.taxcloud.com/tic

- Access TaxCloud comprehensive resources including a tax rate threshold map, tax rate lookup tool, and state-specific sales tax guides: State Guides

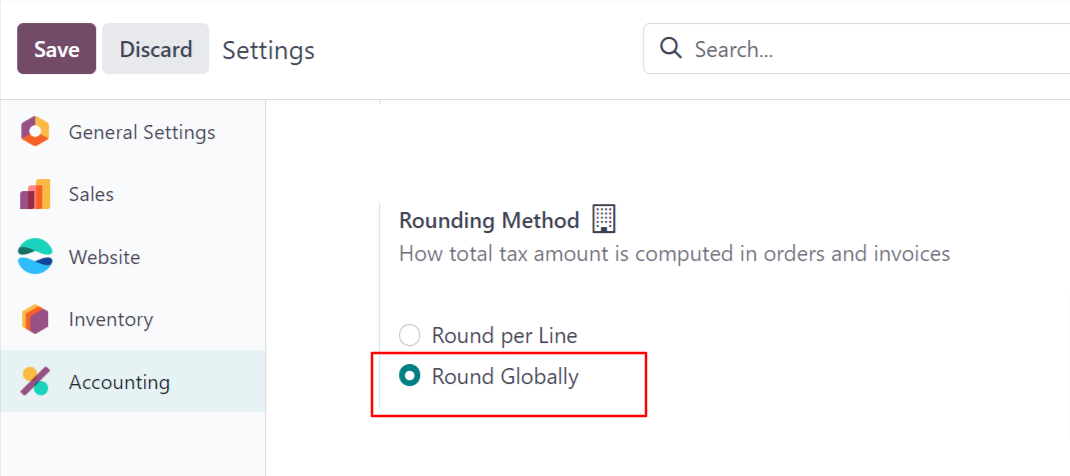

Rounding Method

Go to Accounting - - > Configuration - - > Settings - - > Taxes.

Use the “Round Globally” as the Rounding method to round the tax values.

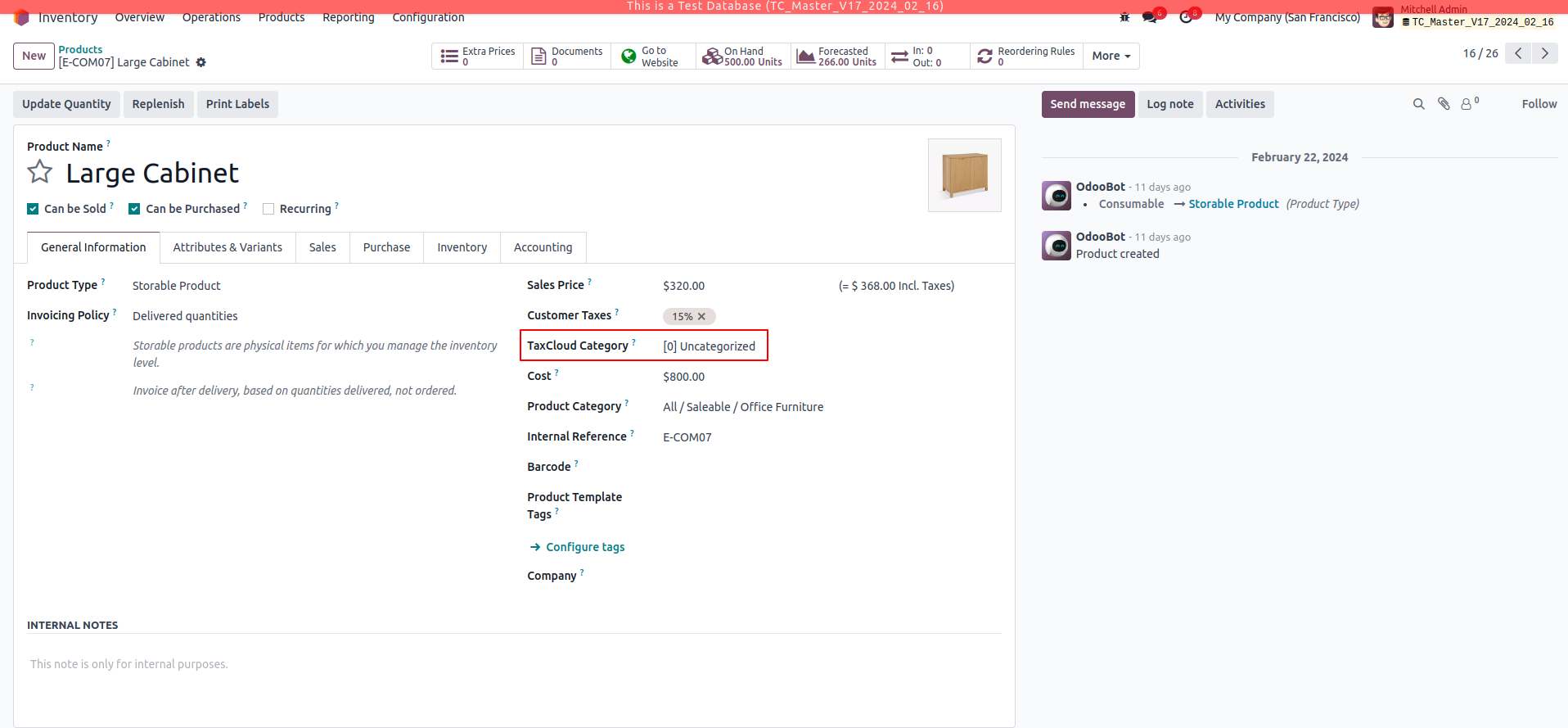

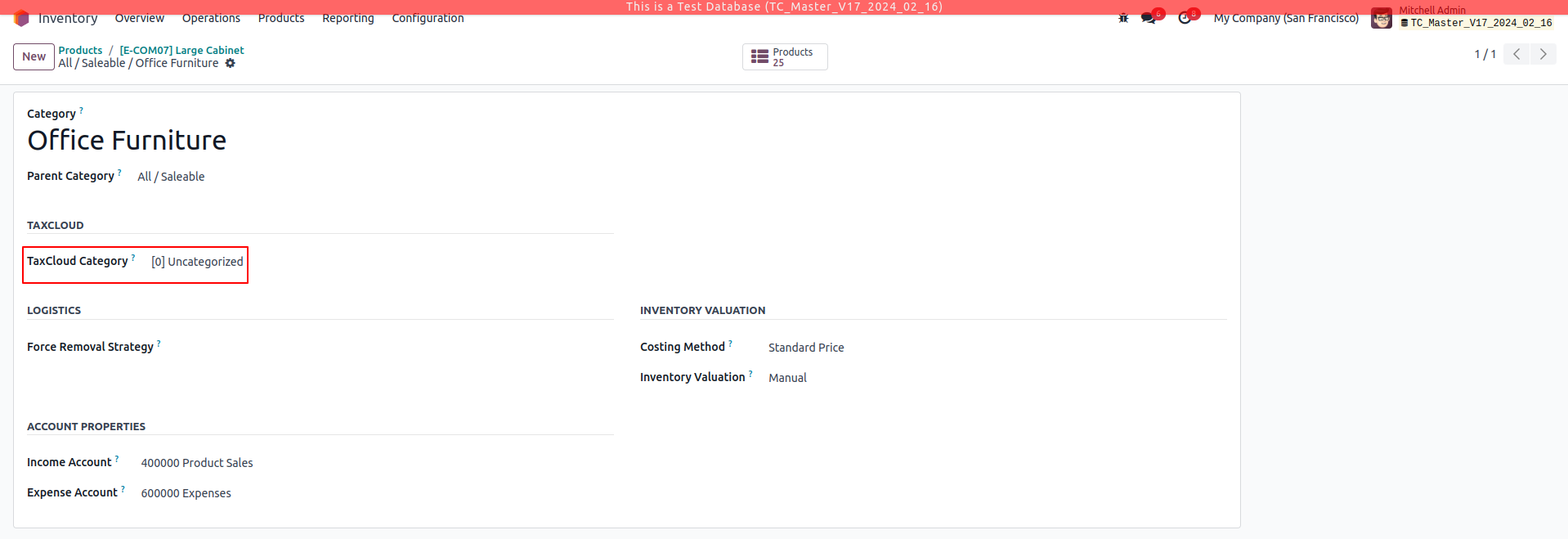

Set Taxcloud Categories on Product:

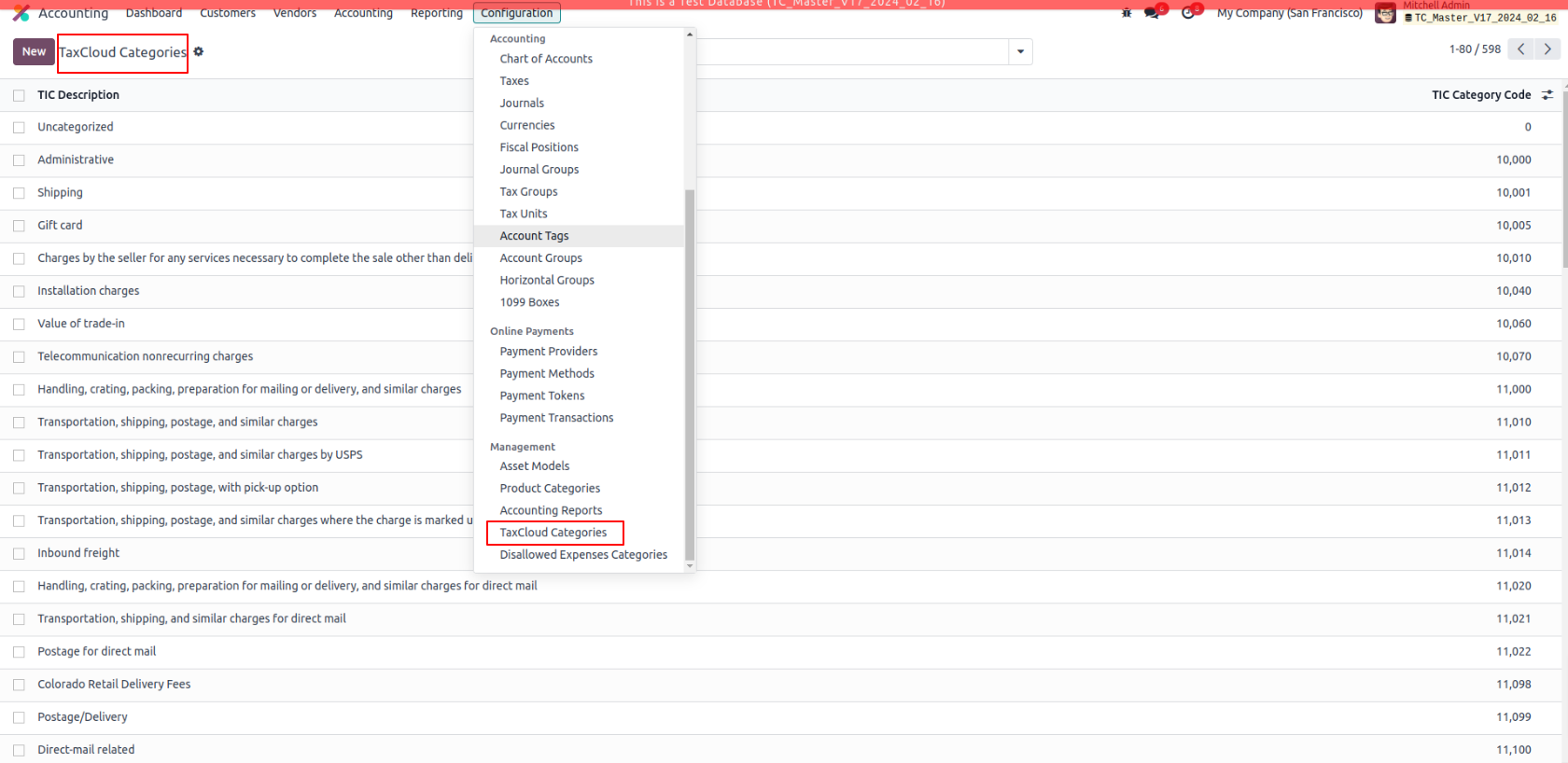

Go to Accounting - - > Configuration - - > Management - - > TaxCloud Categories.

If we set a TaxCloud Category on a product and another on its Product Category, Odoo only considers the TaxCloud Category found on the product itself.

If the TaxCloud Category is not set on a product, then Odoo considers the Taxcloud category set on its Product Category.

If both the TaxCloud Category on a product and its Product Category is not set, the Odoo considers the Default Category set under Accounting Settings.

A TaxCloud Category set on a parent product category does not apply to its child product categories. For example, if we set TaxCloud Category on the All Product Category, it is not applied to the All/Sales Product Category.

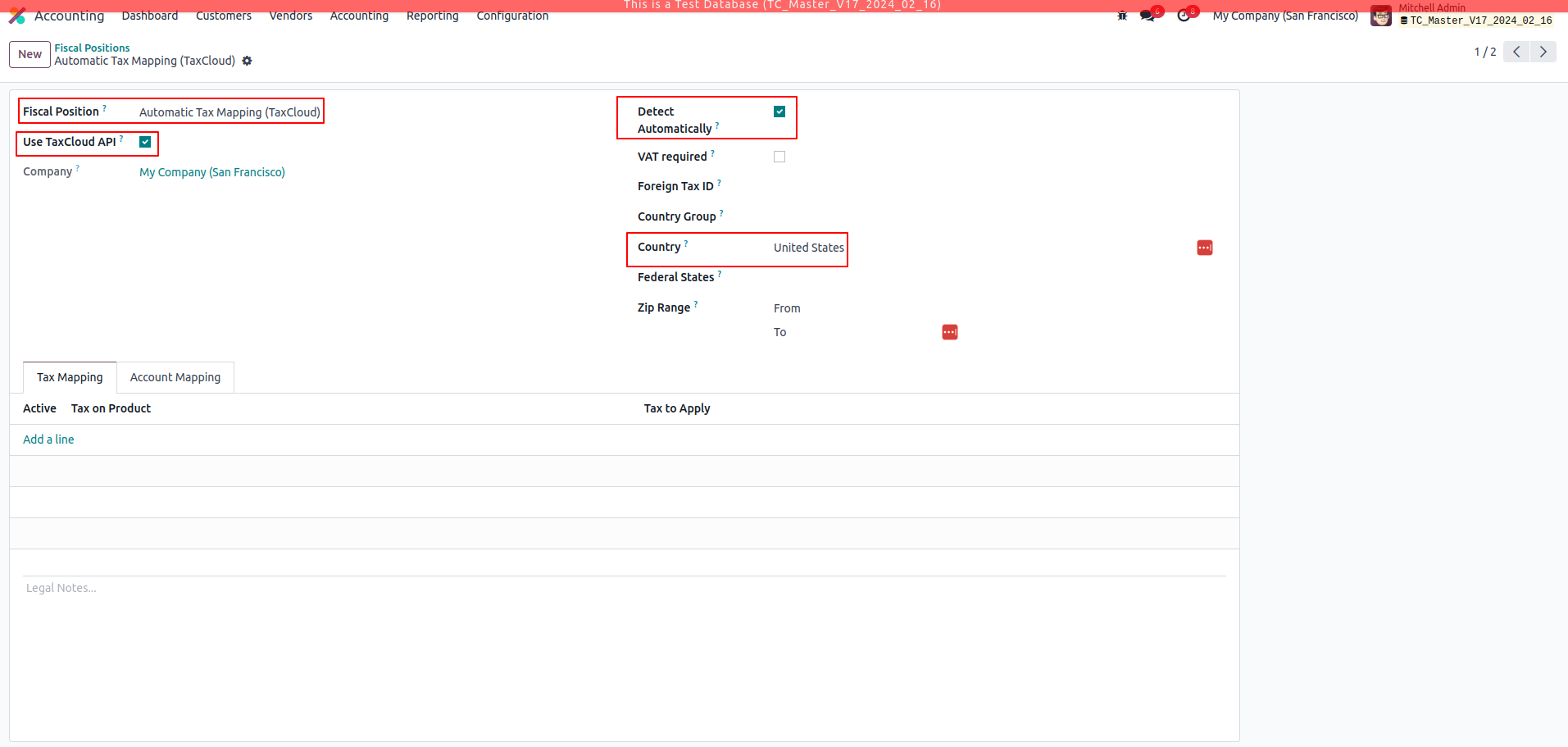

Fiscal Position “Automatic Tax Mapping (TaxCloud)” is created which computes taxes and accounts for invoices with a country set as “United States”.

Use “TaxCloud API” and “Detect Automatically” booleans are enabled in order to compute the taxes from the TaxCloud and to automatically detect the taxes respectively.

Functionality

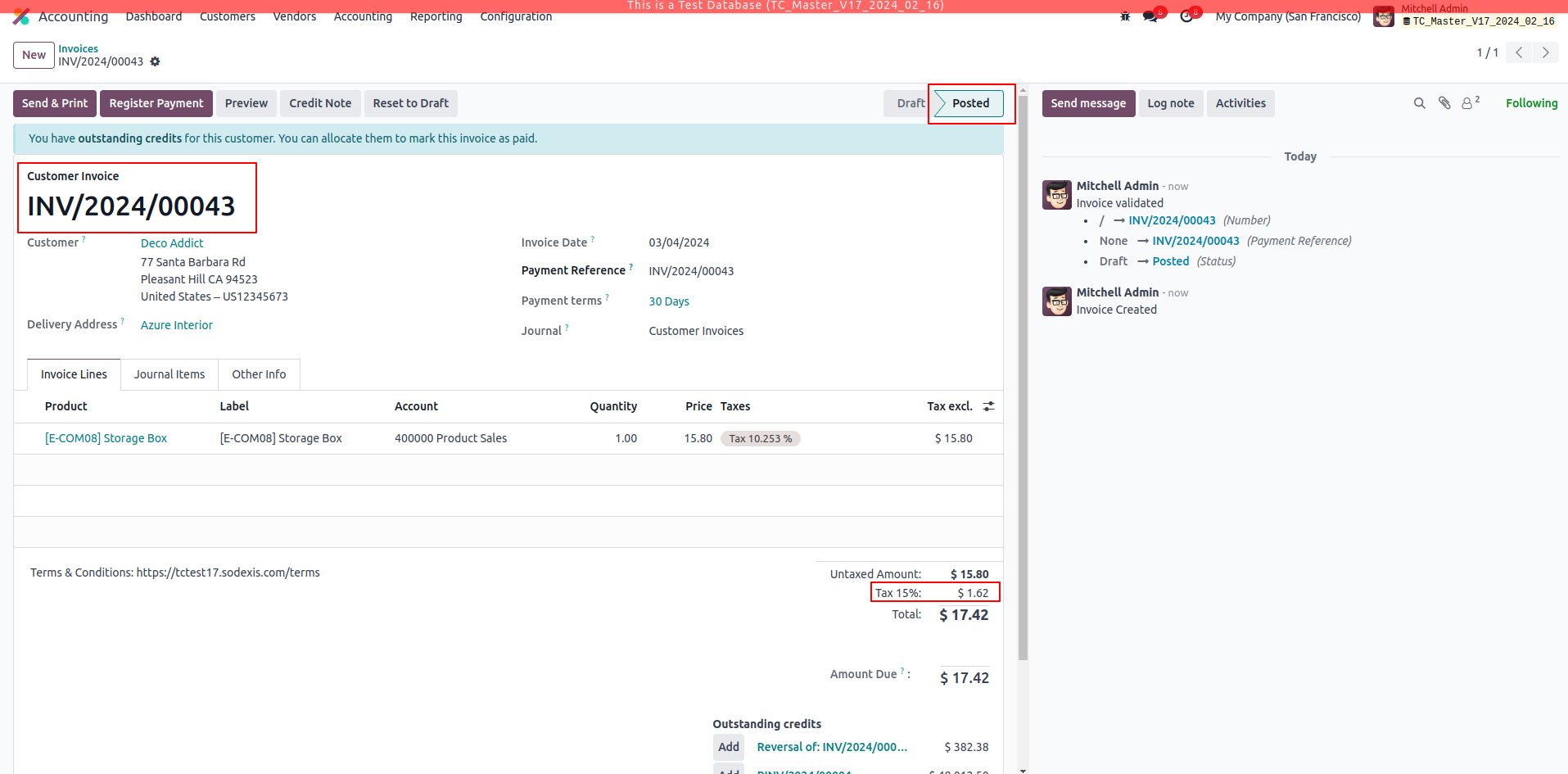

Go to Accounting - - > Customers - - > Invoices. Create a new Invoice.

Note: We cannot compute taxes before the Invoice is posted.

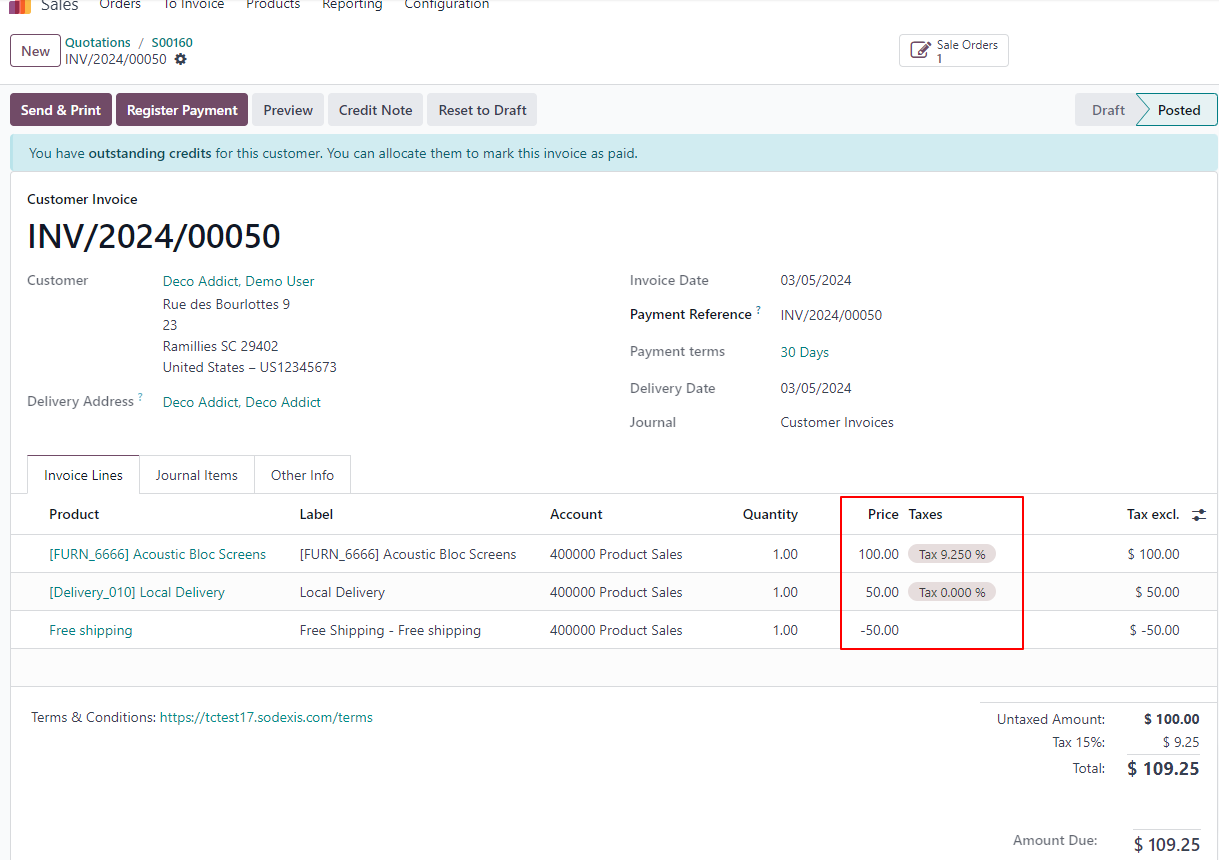

Confirm the Invoice to get it posted. We could see that the computed tax from the Taxcloud is applied in the Invoice as shown below.

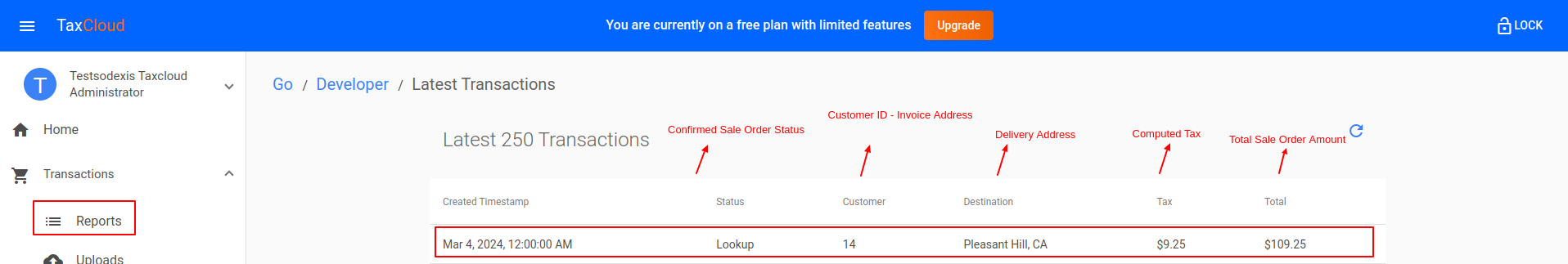

Taxcloud uses the Destination from the "Delivery Address" and the Customer from the "Customer ID" on the invoice.

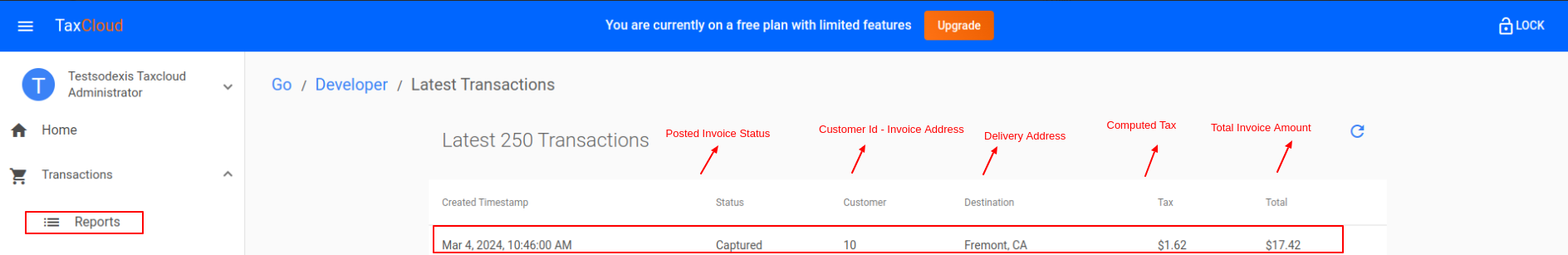

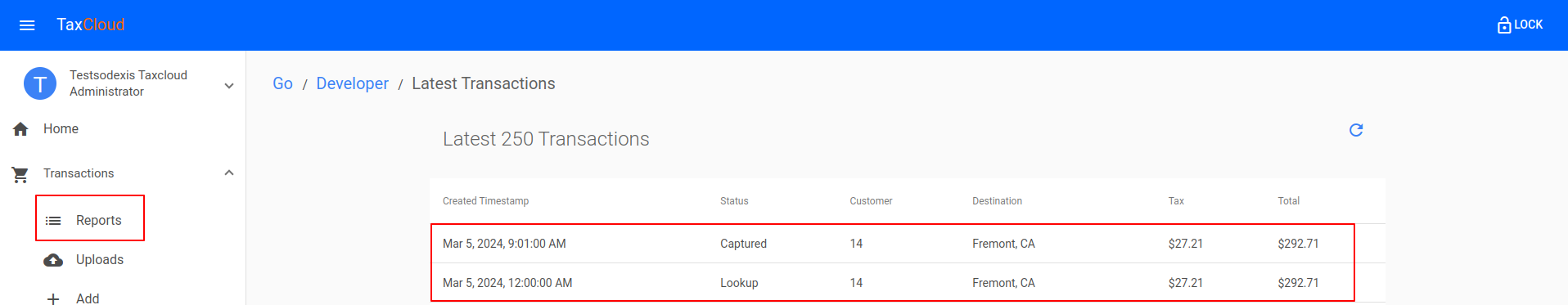

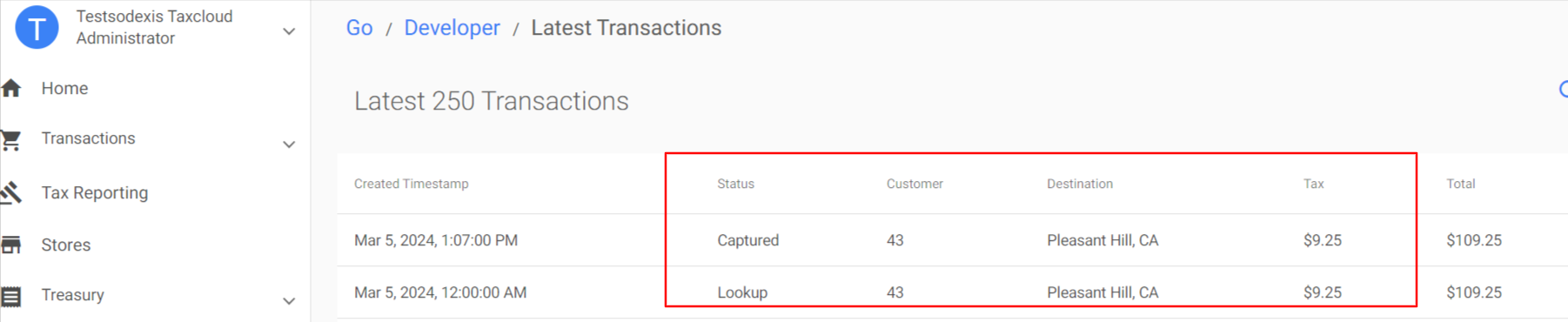

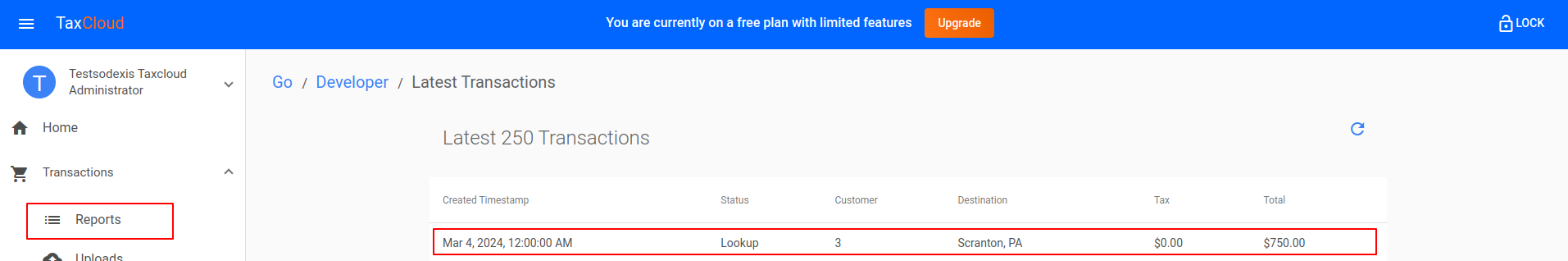

Go to Transactions - - > Reports which shows the recent transactions in Odoo.

We could see that the Status of the Invoice in Taxcloud website will be “Captured” when the Invoice is posted in Odoo.

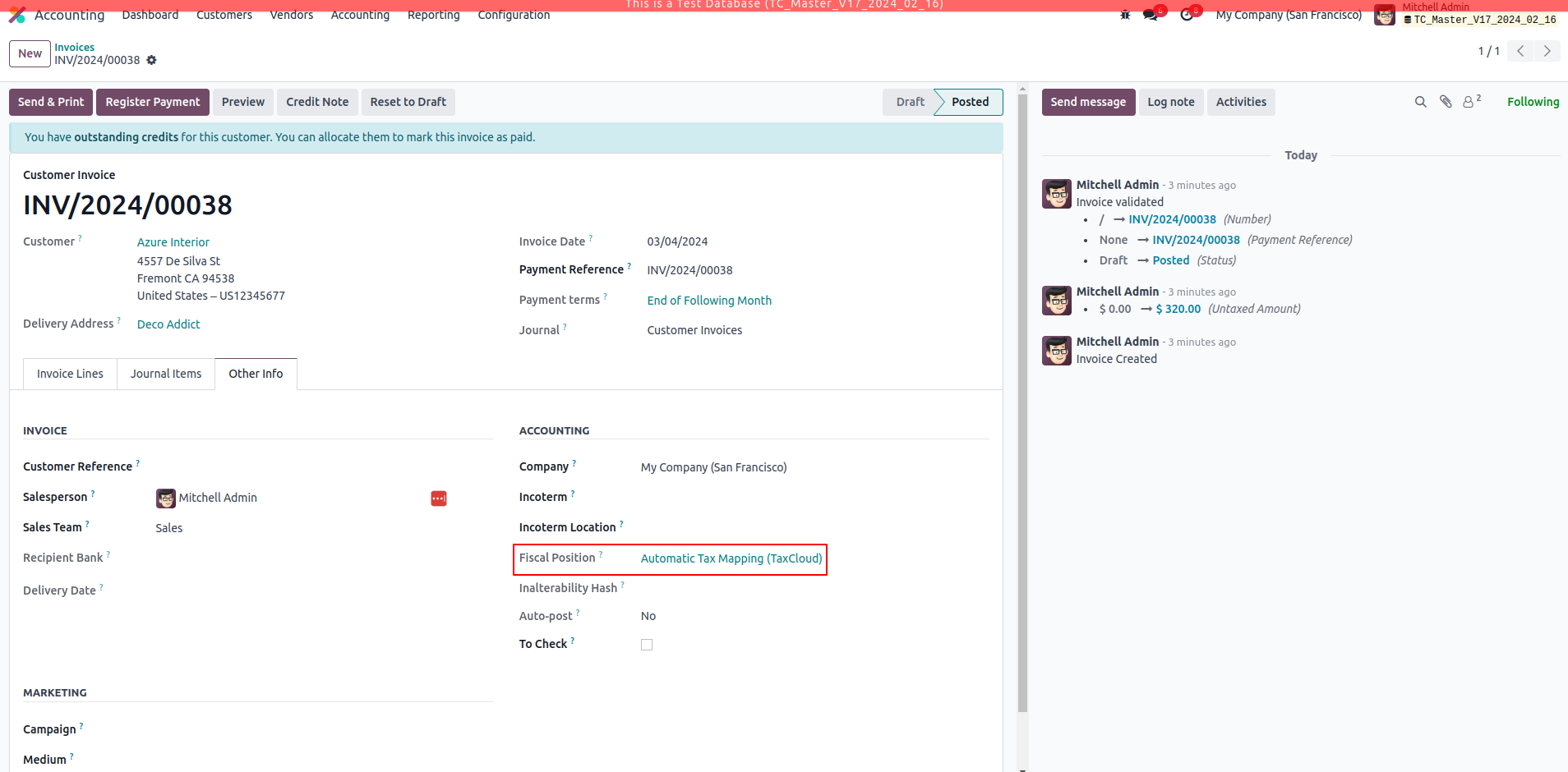

Taxes are computed based on the “Fiscal Position” configured initially which is added under the Other Info tab of the Invoice.

Canceling the Invoice:

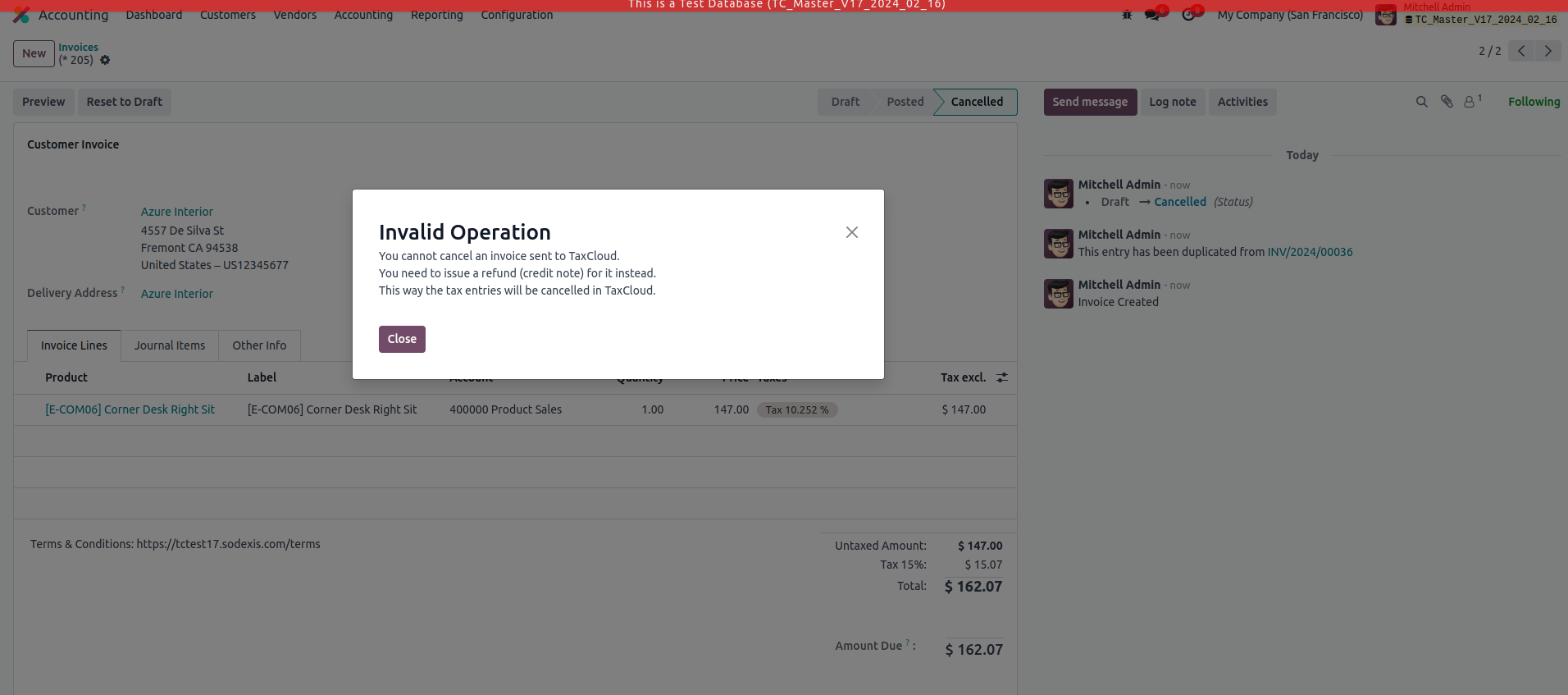

We cannot cancel an Invoice sent to Taxcloud. We will get the below error message while trying to cancel it.

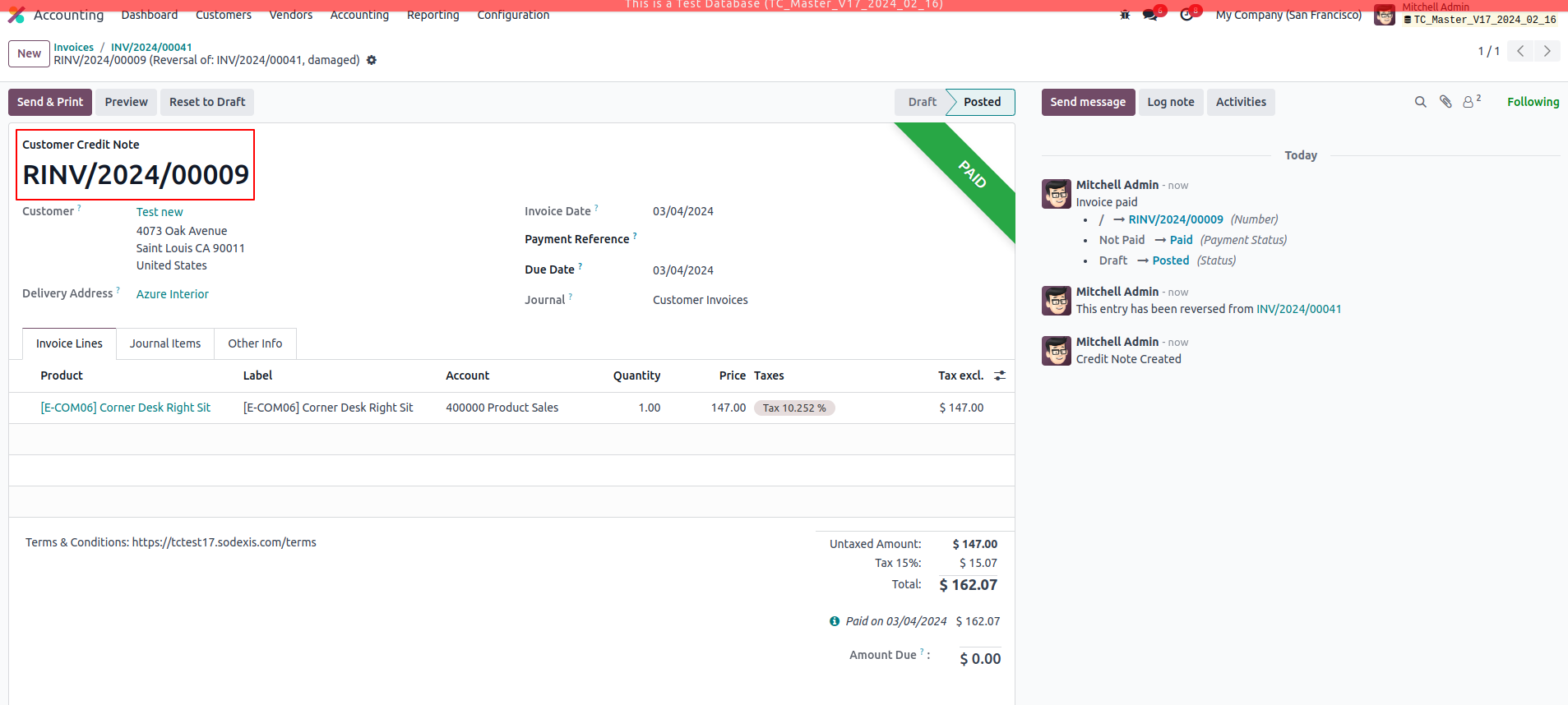

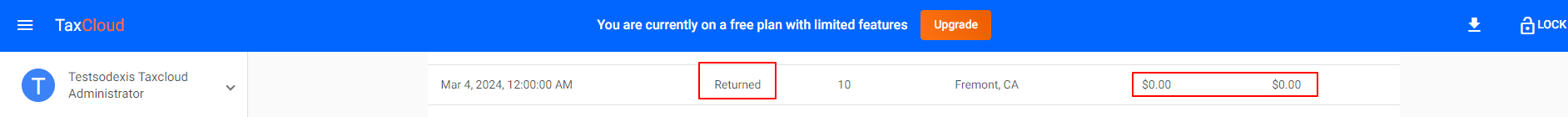

Credit Note:

To reverse the Invoice, we need to create a create note using the “Credit Note” button on the invoice. When credit note is applied for the posted Invoice, TaxCloud updates the tax and total as “0” on the original record with status as “Returned” as shown below.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >

Account TaxCloud - Sale

Description

This module facilitates the integration of Odoo with TaxCloud, enabling automatic computation of sales tax on invoices within the Odoo platform. Starting in Odoo 17, new installations are prohibited, and in Odoo 18 the TaxCloud module(s) won’t exist at all in Odoo. This module will allow you to install it as if it were officially supported by TaxCloud.

This module is configured to compute the sales tax automatically in the Sale Order using TaxCloud.

Module Installation:

- If you were not using the Odoo App previously, you can install the App by clicking on the "Activate" button and then proceed with the configuration.

- If you were using the Odoo TaxCloud App previously, you can install our App by clicking on the “Activate” button. Our module will take care of the transition of configuration and data from the existing module and uninstall the odoo TaxCloud module.

Configuration

The technical and functional configurations are detailed in the documentation for Account TaxCloud. Please refer to the documentation for any questions or technical support.

You can also contact us at <📧 taxcloud@sodexis.com >

Functionality

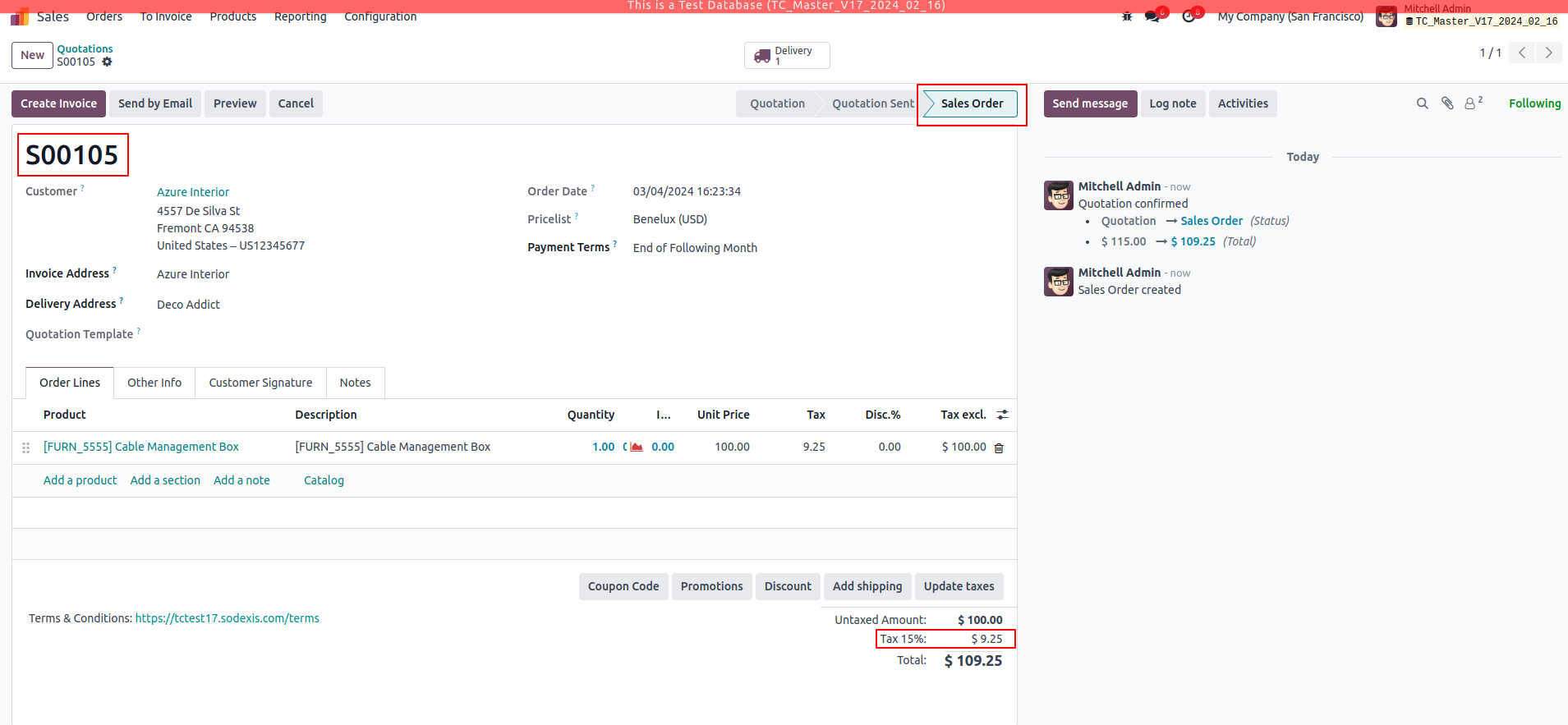

Go to Sales. Create a new sale order, Confirm the same.

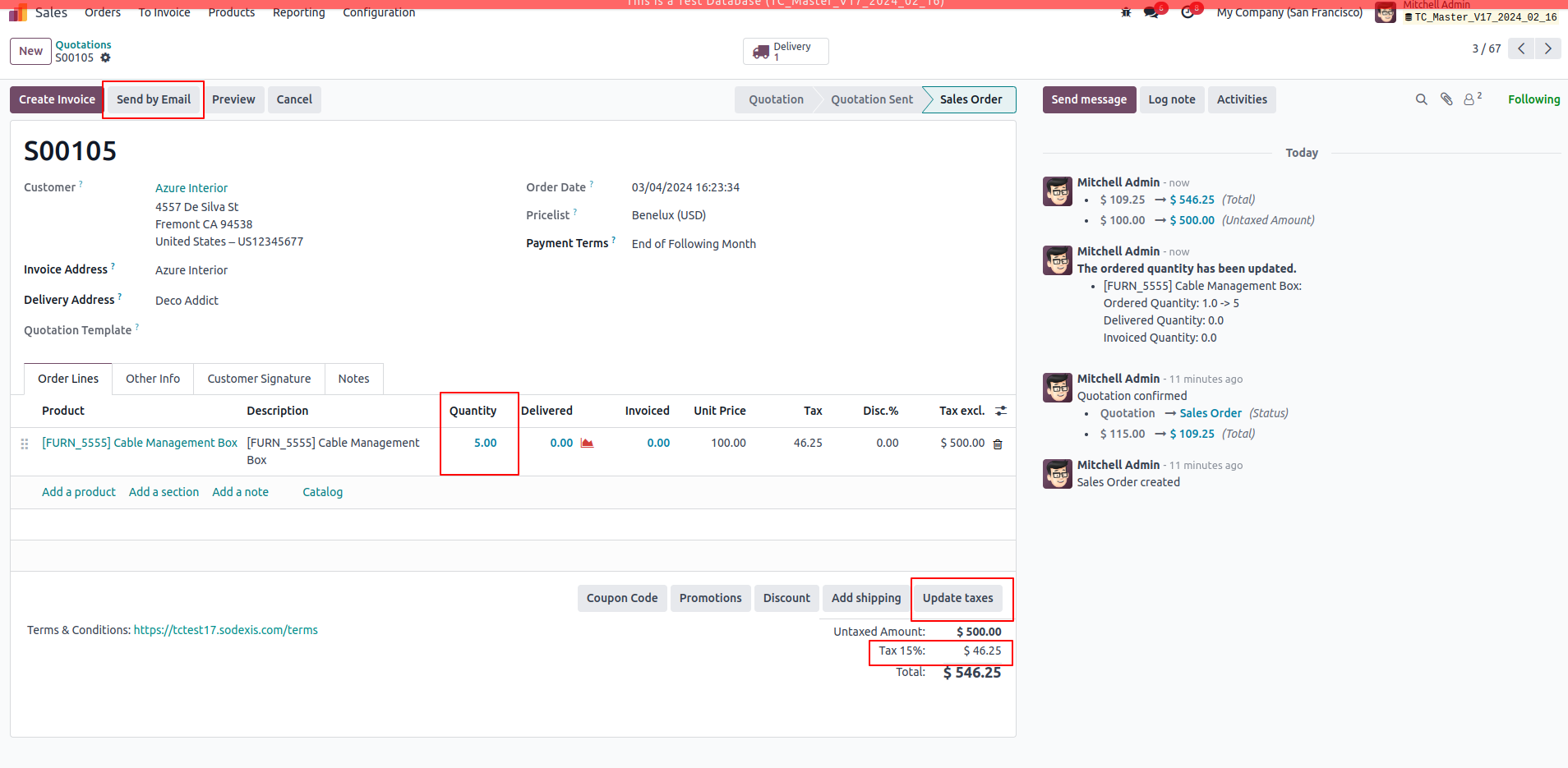

We could see that the computed tax from the TaxCloud is applied in the sale order as shown below.

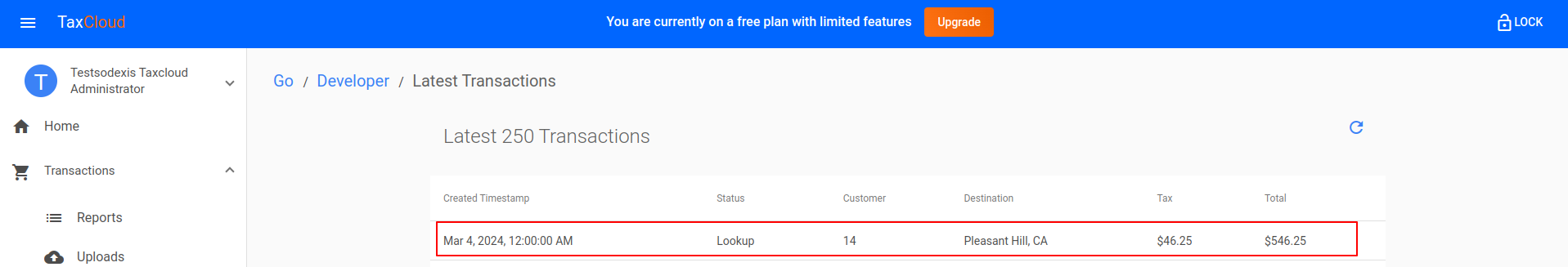

Go to Transactions - - > Reports which shows the recent transactions in Odoo.

We could see that the Status of the Sale Order in the TaxCloud website will be “Lookup” when the Sale Order is confirmed in Odoo.

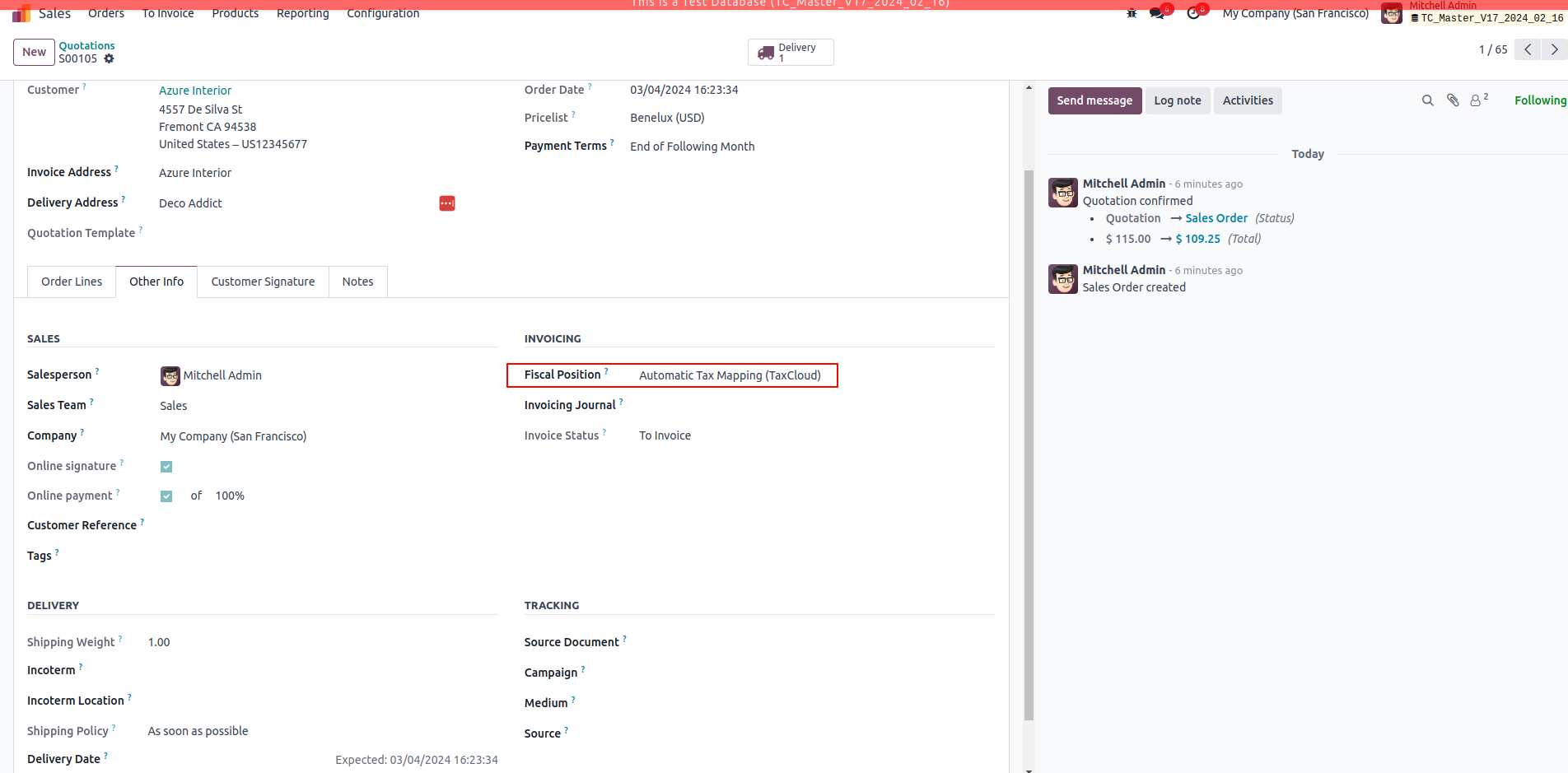

Taxes are computed based on the “Fiscal Position” configured initially which is added under the Other Info tab of the sale order.

If we change the quantity/price of the product in the sale order line and click on “Update taxes/Send by Email” in order to compute taxes from TaxCloud, there will be a new transaction created in the TaxCloud.

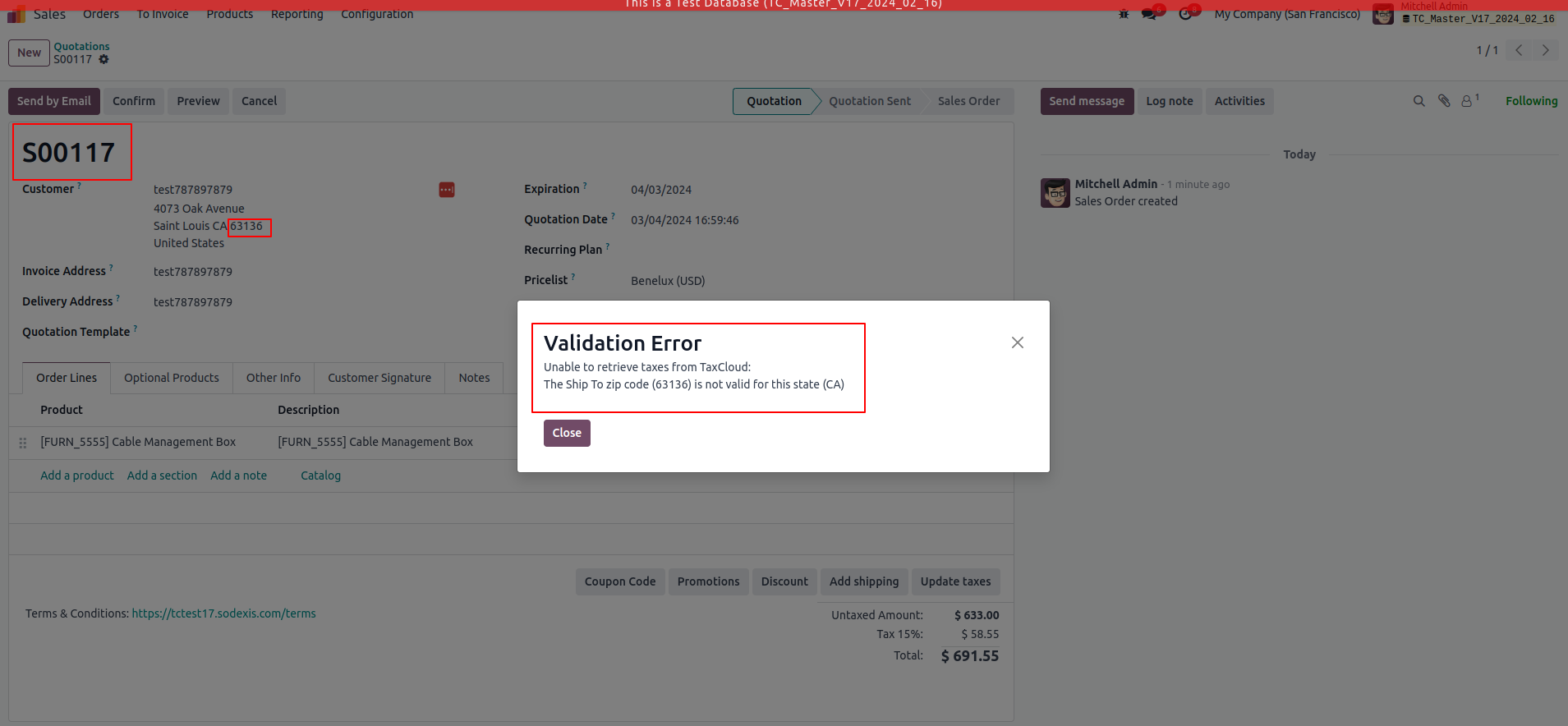

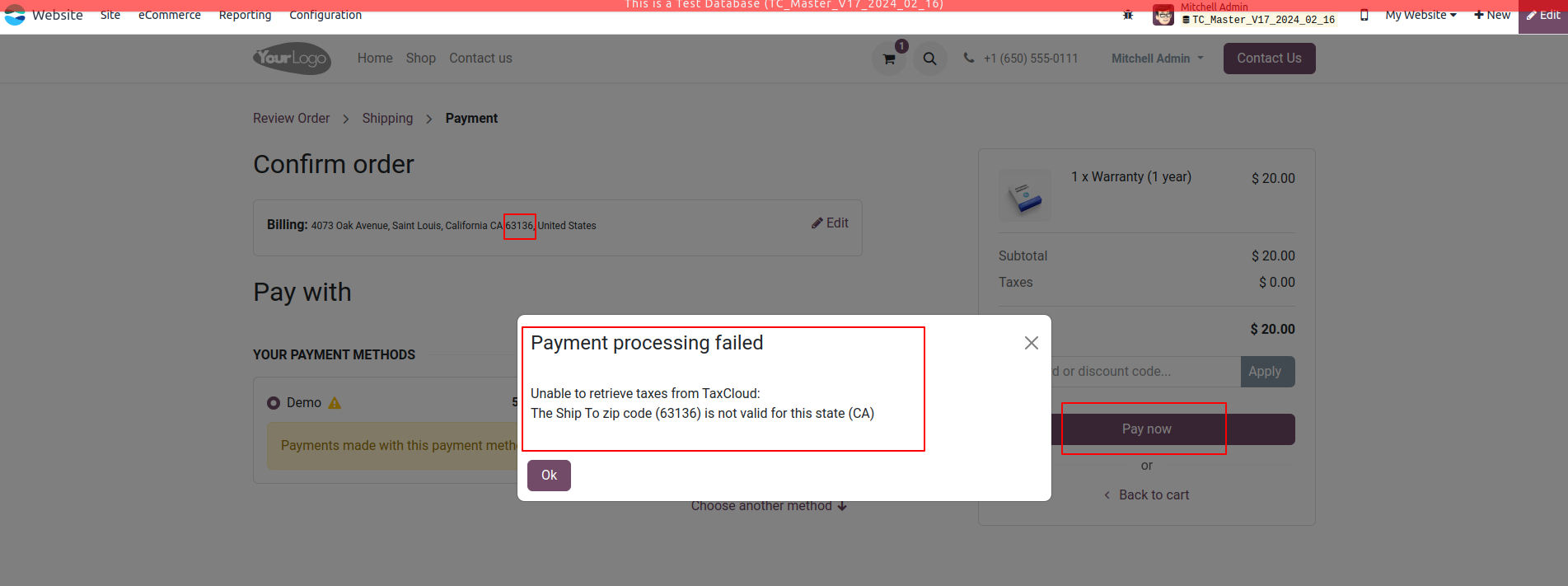

Taxes are calculated based on the Country and its Zip Code. If the Zip code is wrong, then tax will not be calculated which causes a pop-up error.

For detailed information on state sales tax rates and how to determine sales tax rates based on zip codes, use TaxCloud's US Sales Tax Calculator.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >

Account TaxCloud - Sale (loyalty)

Description

This module facilitates the integration of Odoo with TaxCloud, enabling automatic computation of sales tax on invoices within the Odoo platform. Starting in Odoo 17, new installations are prohibited, and in Odoo 18 the TaxCloud module(s) won’t exist at all in Odoo. This module helps to manage discounts in tax computations on the TaxCloud.

Module Installation:

- If you were not using the Odoo App previously, you can install the App by clicking on the "Activate" button and then proceed with the configuration.

- If you were using the Odoo TaxCloud App previously, you can install our App by clicking on the “Activate” button. Our module will take care of the transition of configuration and data from the existing module and uninstall the odoo TaxCloud module.

Configuration

The technical and functional configurations are detailed in the documentation for Account TaxCloud. Please refer to the documentation for any questions or technical support.

You can also contact us at <📧 taxcloud@sodexis.com >

Functionality

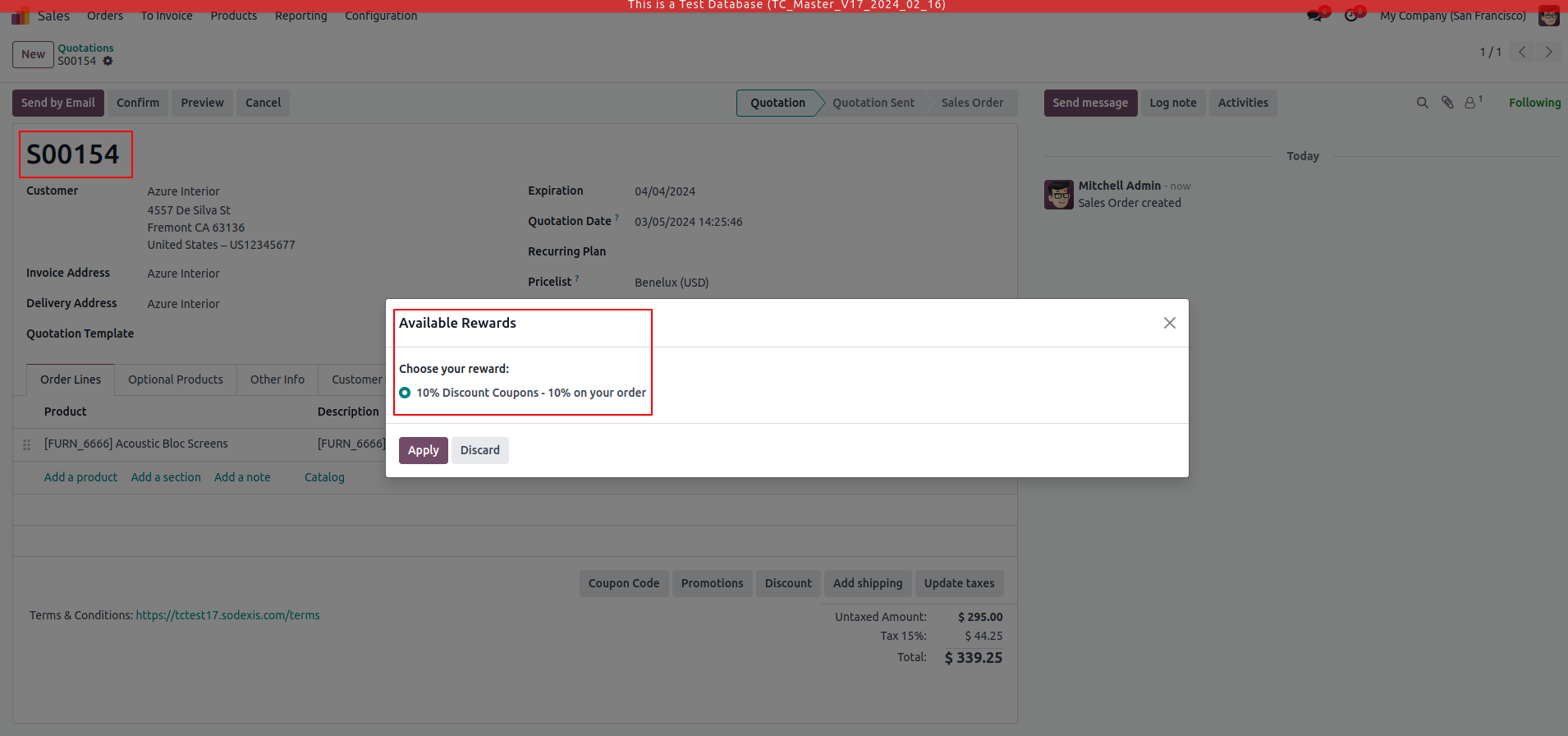

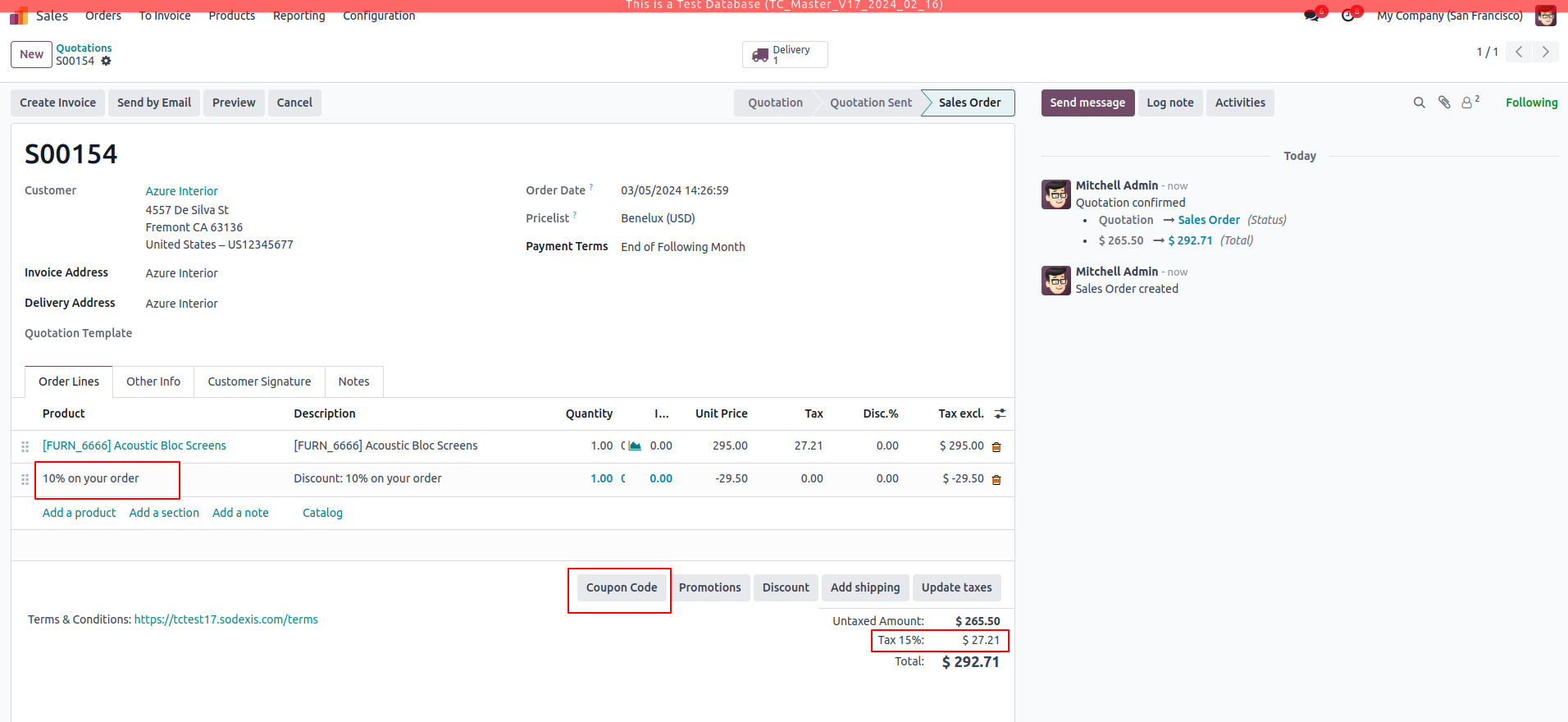

Go to Sales. Create a new sale order, Confirm the same.

Applying Loyalty as 10% to the sale order.

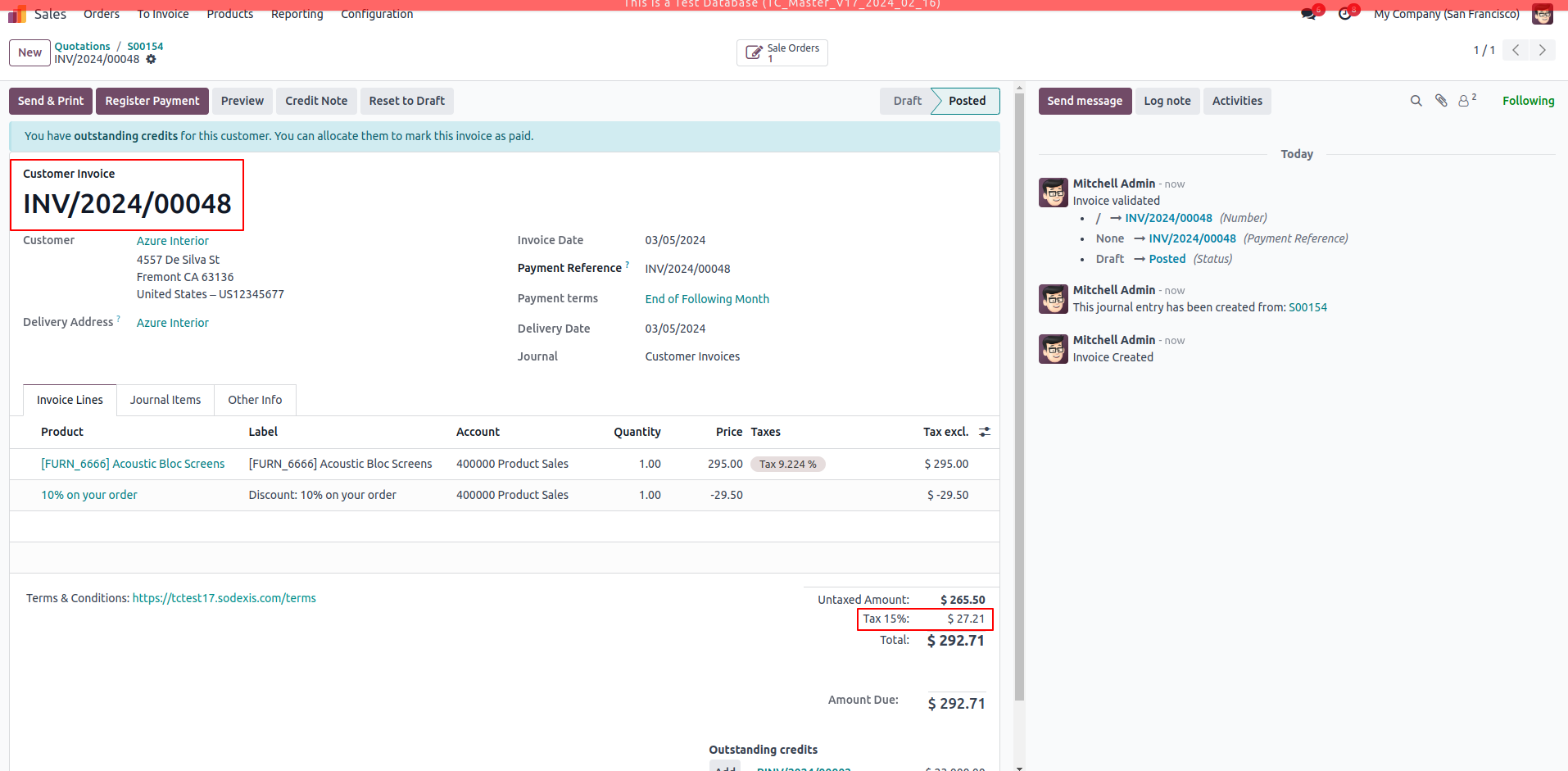

This module calculates the tax only for the discounted price in both sale order and invoice.

In the TaxCloud website, Go to Transactions - - > Reports which shows the recent transactions in Odoo.

We could see the Status of the sale order as “Lookup” and Invoice as “Captured” with the computed taxes as shown below.

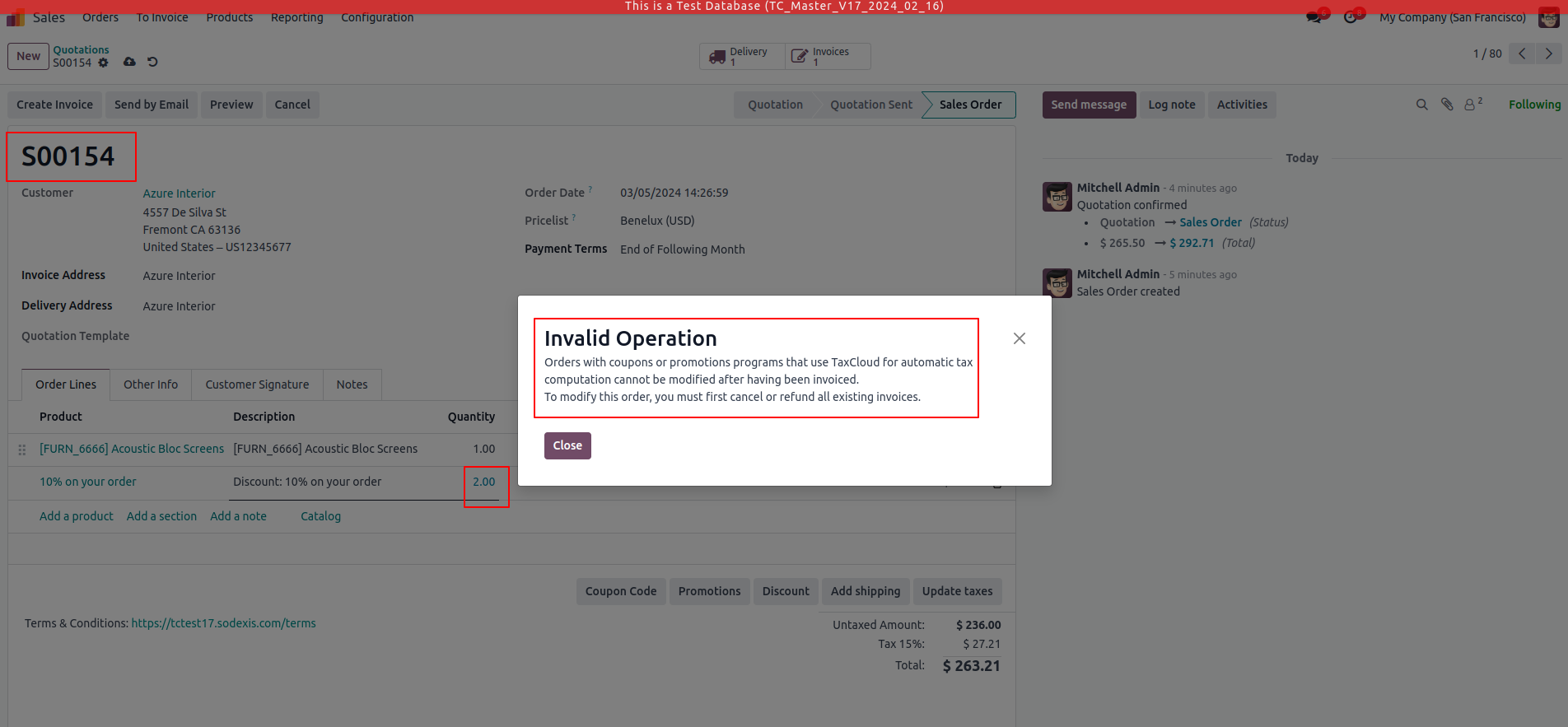

If the order has coupon applied and invoice, then the users are not allowed to modify quantity or add a new sale order line which causes a pop-up error.

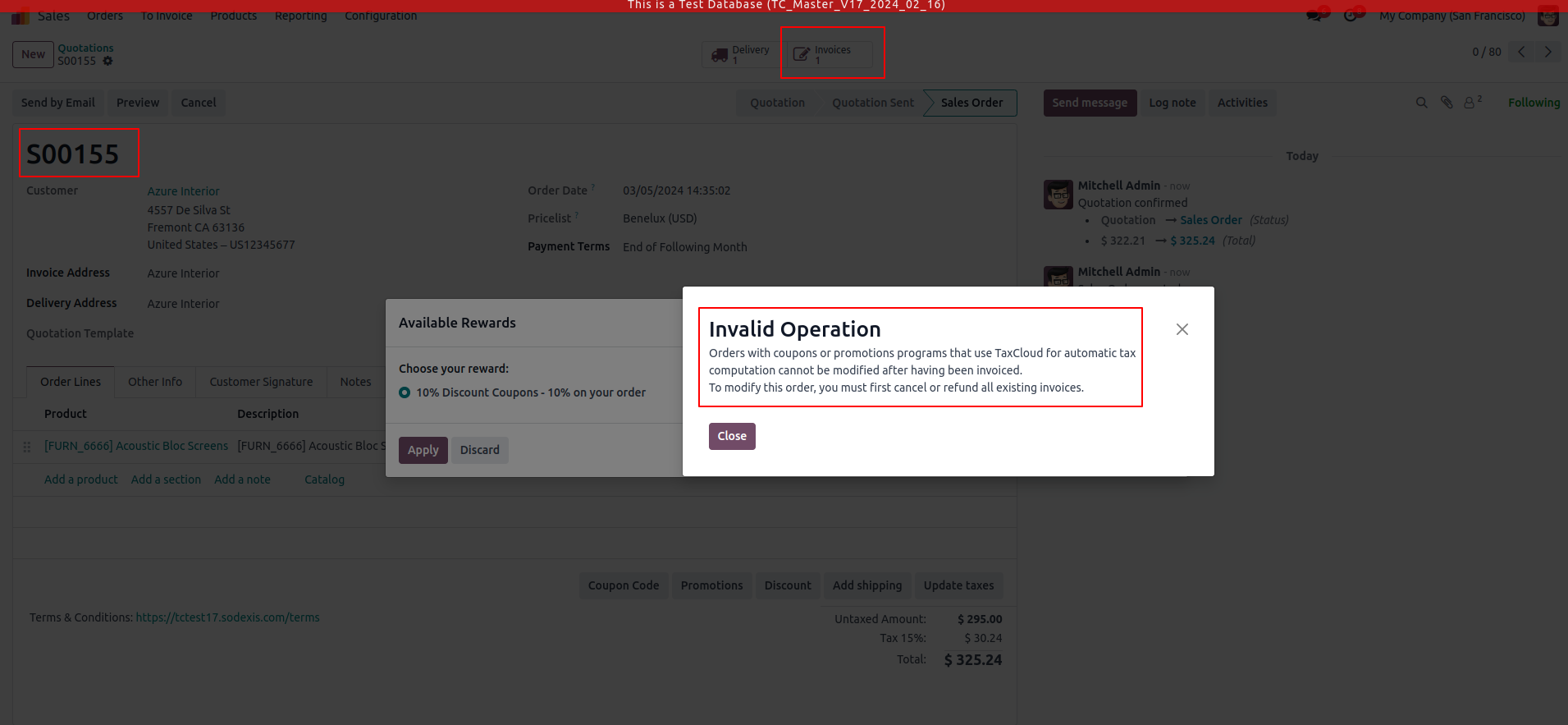

Users are not allowed to apply coupon when the Sale order is already invoiced.

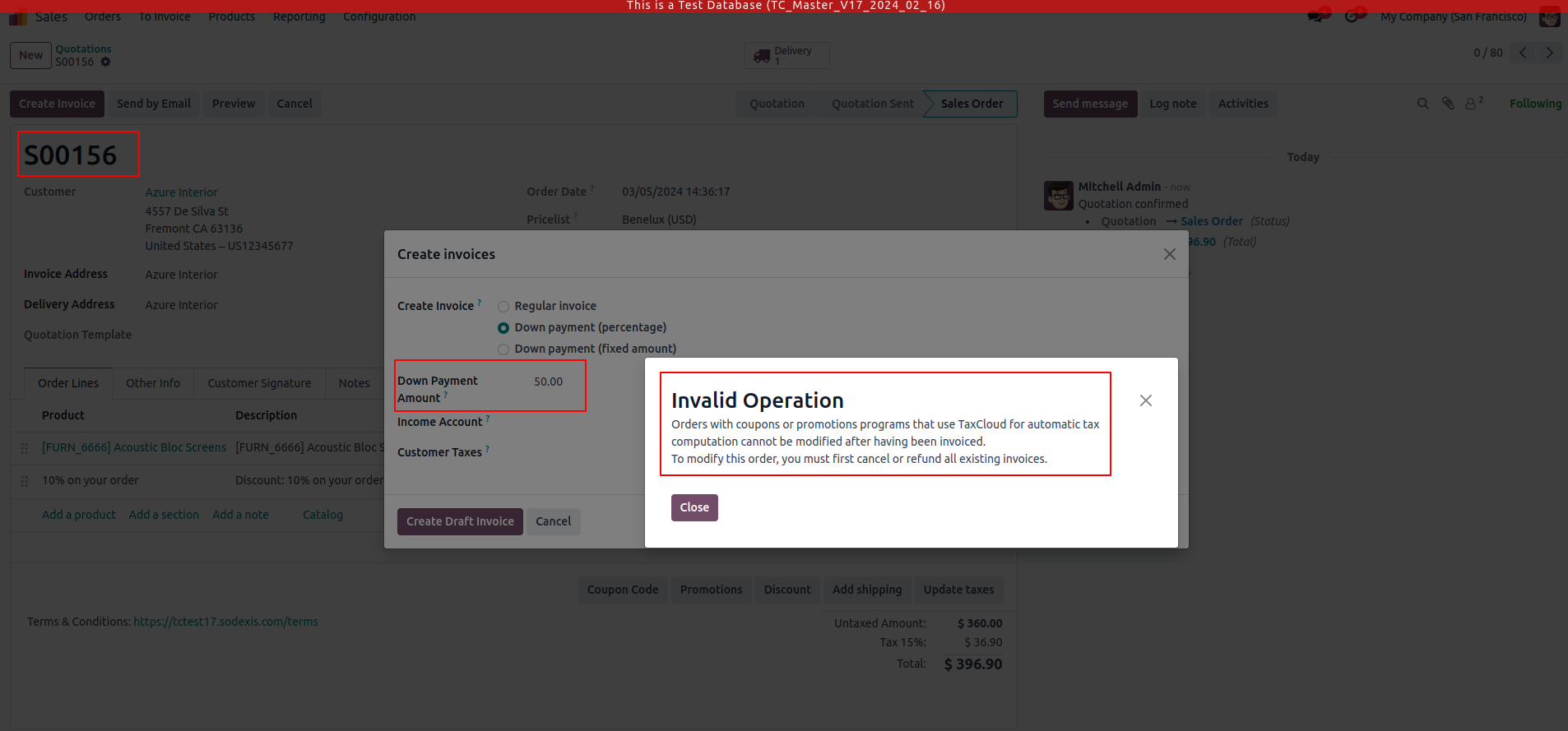

Users are not allowed to do partial invoice which causes a pop-up error.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >

Account TaxCloud - Sale (loyalty) - Delivery

Description

This module facilitates the integration of Odoo with TaxCloud, enabling automatic computation of sales tax on invoices within the Odoo platform. Starting in Odoo 17, new installations are prohibited, and in Odoo 18 the TaxCloud module(s) won’t exist at all in Odoo. This module will allow you to install it as if it was officially supported by TaxCloud.

This module is configured to manage discounts in TaxClouds computations with delivery and follows the same logic as "Account TaxCloud - Sale (coupon)". There is an added option for discount (free shipping) on deliveries. With Sale coupon delivery, the discount computation does not apply on delivery lines.

Module Installation:

- If you were not using the Odoo App previously, you can install the App by clicking on the "Activate" button and then proceed with the configuration.

- If you were using the Odoo TaxCloud App previously, you can install our App by clicking on the “Activate” button. Our module will take care of the transition of configuration and data from the existing module and uninstall the odoo TaxCloud module.

Configuration

The technical and functional configurations are detailed in the documentation for Account TaxCloud. Please refer to the documentation for any questions or technical support.

You can also contact us at <📧 taxcloud@sodexis.com >

Functionality

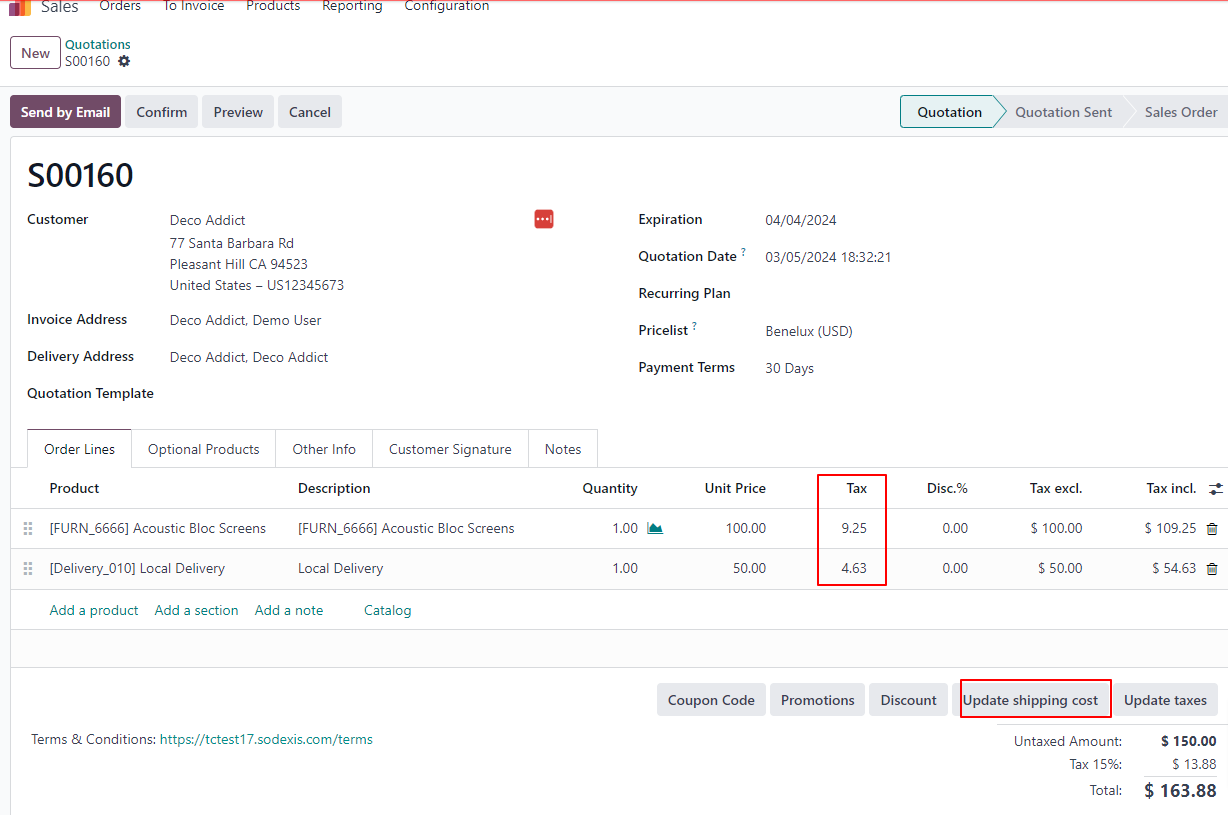

Go to Sales. Create a new sale order, Confirm the same.

Click on “Update Shipping Cost” to add the shipping in the sale order line.

Without applying the coupon code, it computes the taxes for both the product and the shipping as shown below.

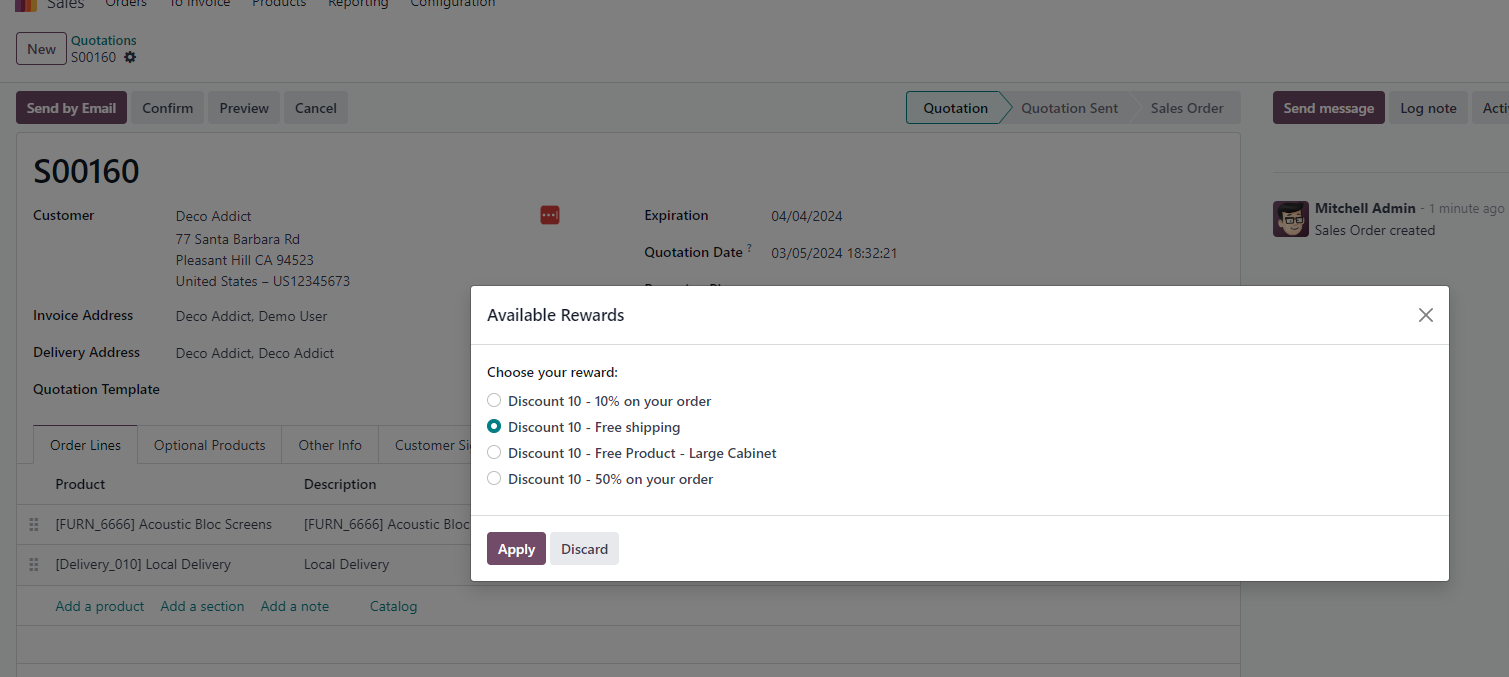

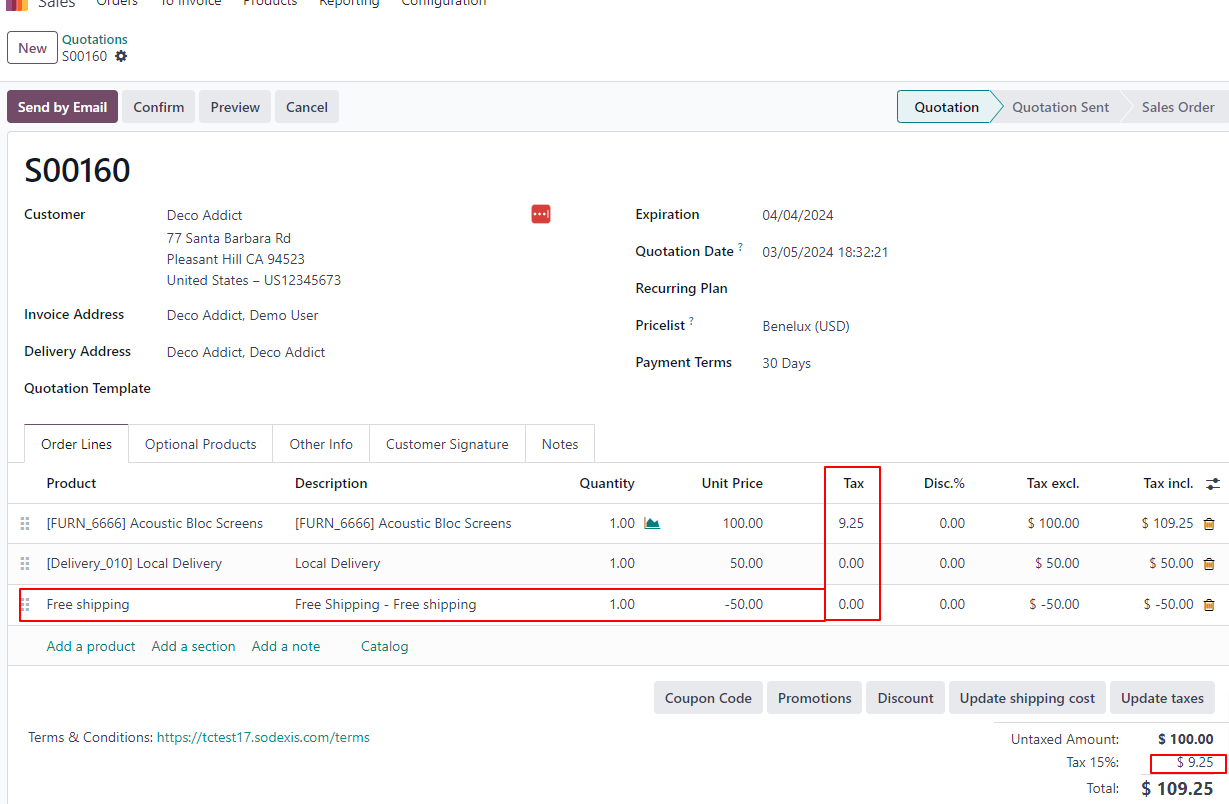

With coupon code “Discount 10 - Free shipping” applied, the module computes only the product tax excluding the shipping cost.

We can also see the computed tax for the product in the Invoice.

In the TaxCloud website, Go to Transactions - - > Reports which shows the recent transactions in Odoo.

We could see the Status of the sale order as “Lookup” and Invoice as “Captured” with the computed taxes as shown below.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >

Account TaxCloud - Ecommerce

Description

This module facilitates the integration of Odoo with TaxCloud, enabling automatic computation of sales tax on invoices within the Odoo platform. Starting in Odoo 17, new installations are prohibited, and in Odoo 18 the TaxCloud module(s) won’t exist at all in Odoo. This module will allow you to install it as if it was officially supported by TaxCloud. The connector acts as a bridge between Odoo

and TaxCloud, ensuring a seamless and efficient tax calculation process in eCommerce.

Module Installation:

- If you were not using the Odoo App previously, you can install the App by clicking on the "Activate" button and then proceed with the configuration.

- If you were using the Odoo TaxCloud App previously, you can install our App by clicking on the “Activate” button. Our module will take care of the transition of configuration and data from the existing module and uninstall the odoo TaxCloud module.

Configuration

The technical and functional configurations are detailed in the documentation for Account TaxCloud. Please refer to the documentation for any questions or technical support.

You can also contact us at <📧 taxcloud@sodexis.com >

Functionality

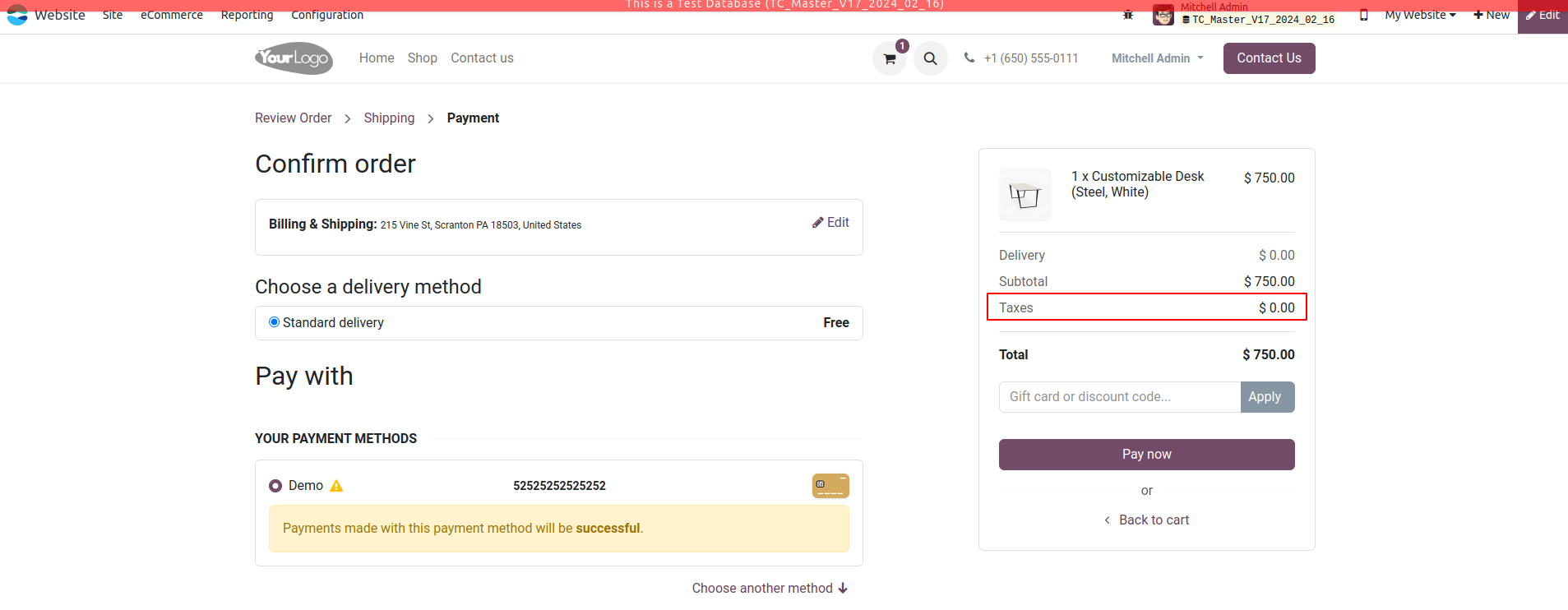

Go to Website - - > Shop. Place an order.

We could see that the computed tax from the TaxCloud is applied in the website as shown below.

Taxes are calculated based on the Country and its Zip Code. If the Zip code is wrong, then tax will not be calculated which causes a pop-up error while processing the payment through the shop.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >

Amazon/TaxCloud Bridge

Description

This module facilitates the integration of Odoo

with TaxCloud. Starting in Odoo 17, new installations are prohibited, and in Odoo 18 the TaxCloud module(s) won’t exist at all in Odoo. This module will allow you to install it as if it was officially supported by TaxCloud.

The connector acts as a bridge between Odoo and TaxCloud, ensuring a seamless and efficient tax calculation process in amazon orders.

Module Installation:

- If you were not using the Odoo App previously, you can install the App by clicking on the "Activate" button and then proceed with the configuration.

- If you were using the Odoo TaxCloud App previously, you can install our App by clicking on the “Activate” button. Our module will take care of the transition of configuration and data from the existing module and uninstall the odoo TaxCloud module.

Configuration

The technical and functional configurations are detailed in the documentation for Account TaxCloud. Please refer to the documentation for any questions or technical support.

You can also contact us at <📧 taxcloud@sodexis.com >

Functionality

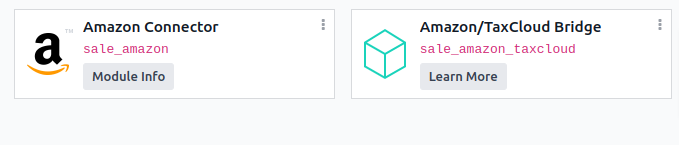

This module is not auto-installed and is installed while installing Amazon Connector module.

If the sale order is an amazon order, TaxCloud won’t compute tax on the SO even though all the conditions are met since Amazon computes tax from its end.

This module skips the tax computation for Amazon Order alone.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >

TaxCloud and Subscriptions

Description

This module facilitates the integration of Odoo with TaxCloud

. Starting in Odoo 17, new installations are prohibited, and in Odoo 18 the TaxCloud module(s) won’t exist at all in Odoo, so this module will allow you to install it as if this was officially supported by TaxCloud.

This connector acts as a bridge between Odoo and TaxCloud, ensuring a seamless and efficient tax calculation process. Compute tax with TaxCloud after automatic invoice creation and ensure that the taxes are computed on the invoice before a payment is created automatically for a subscription.

Module Installation:

- If you were not using the Odoo App previously, you can install the App by clicking on the "Activate" button and then proceed with the configuration.

- If you were using the Odoo TaxCloud App previously, you can install our App by clicking on the “Activate” button. Our module will take care of the transition of configuration and data from the existing module and uninstall the odoo TaxCloud module.

Configuration

The technical and functional configurations are detailed in the documentation for Account TaxCloud. Please refer to the documentation for any questions or technical support.

You can also contact us at <📧 taxcloud@sodexis.com >

Functionality

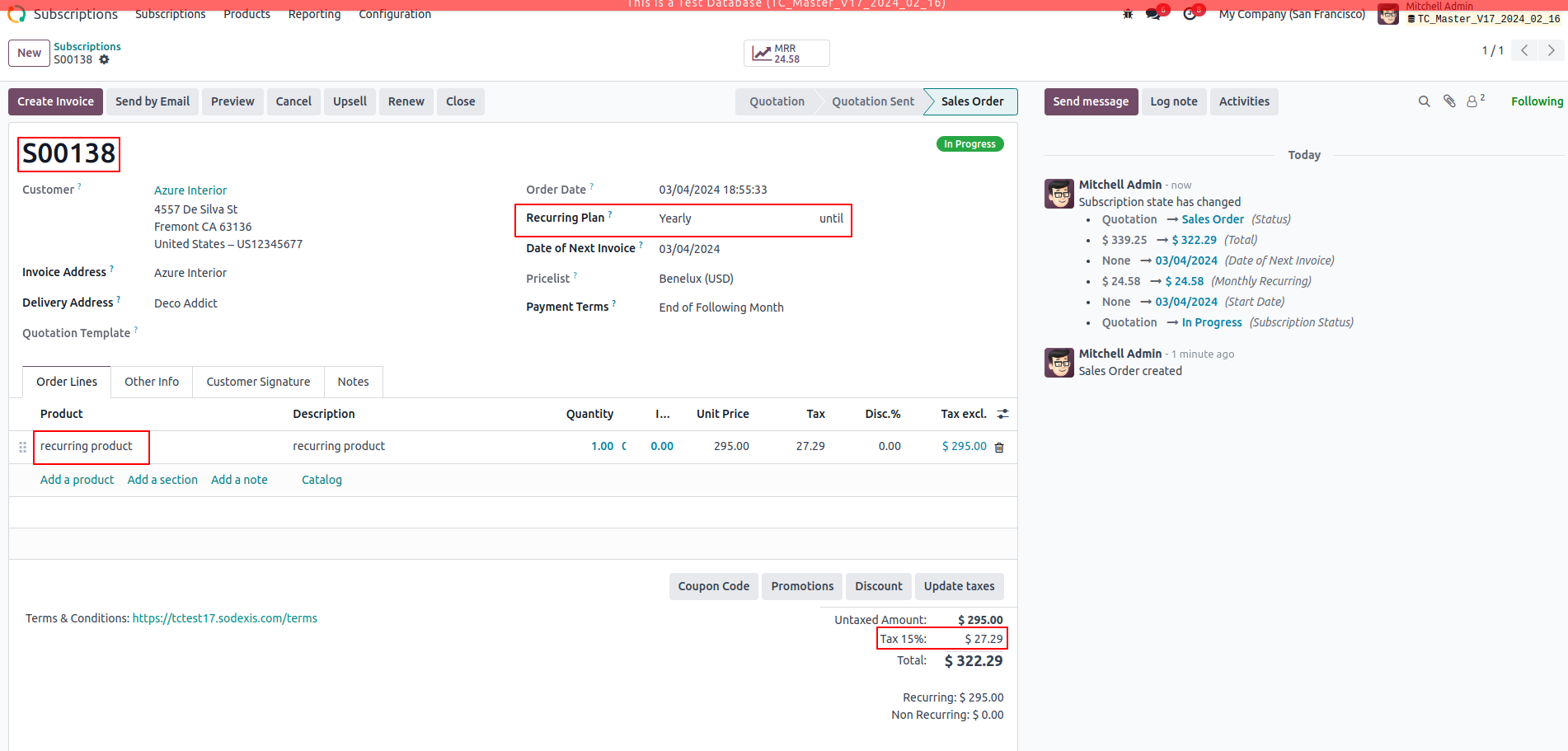

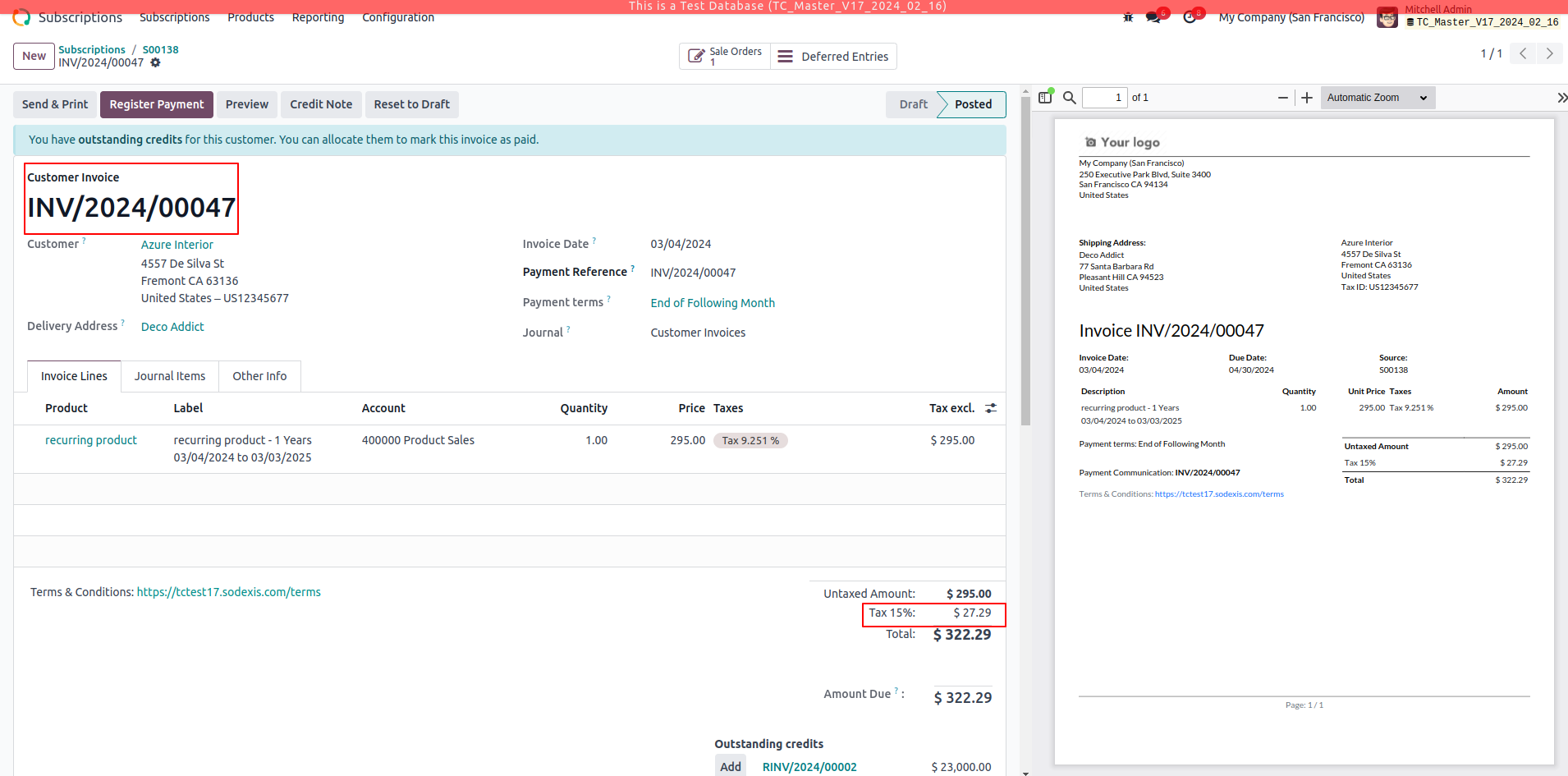

Go to Subscriptions.

Create a new subscription for the customer with the Recurring Product and the chosen Recurring Plan.

In Odoo, subscription products are also called recurring products.

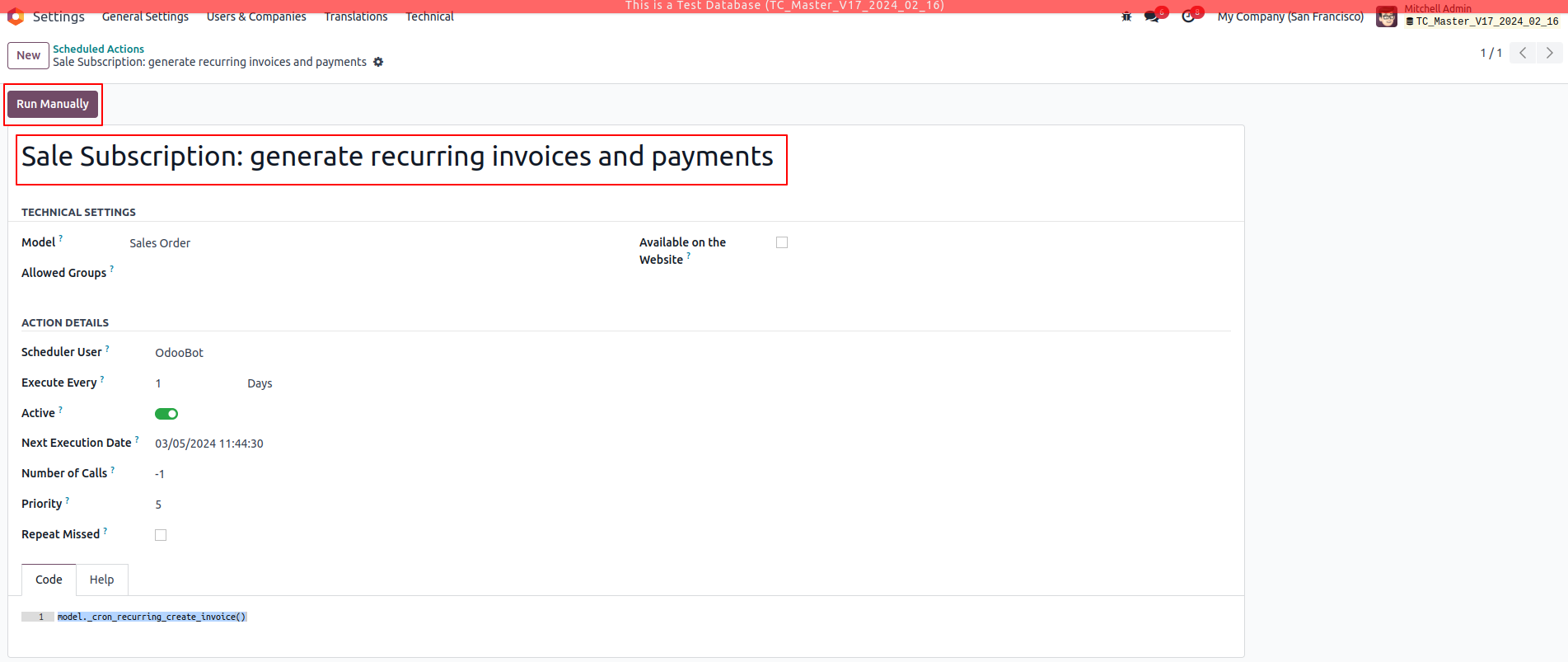

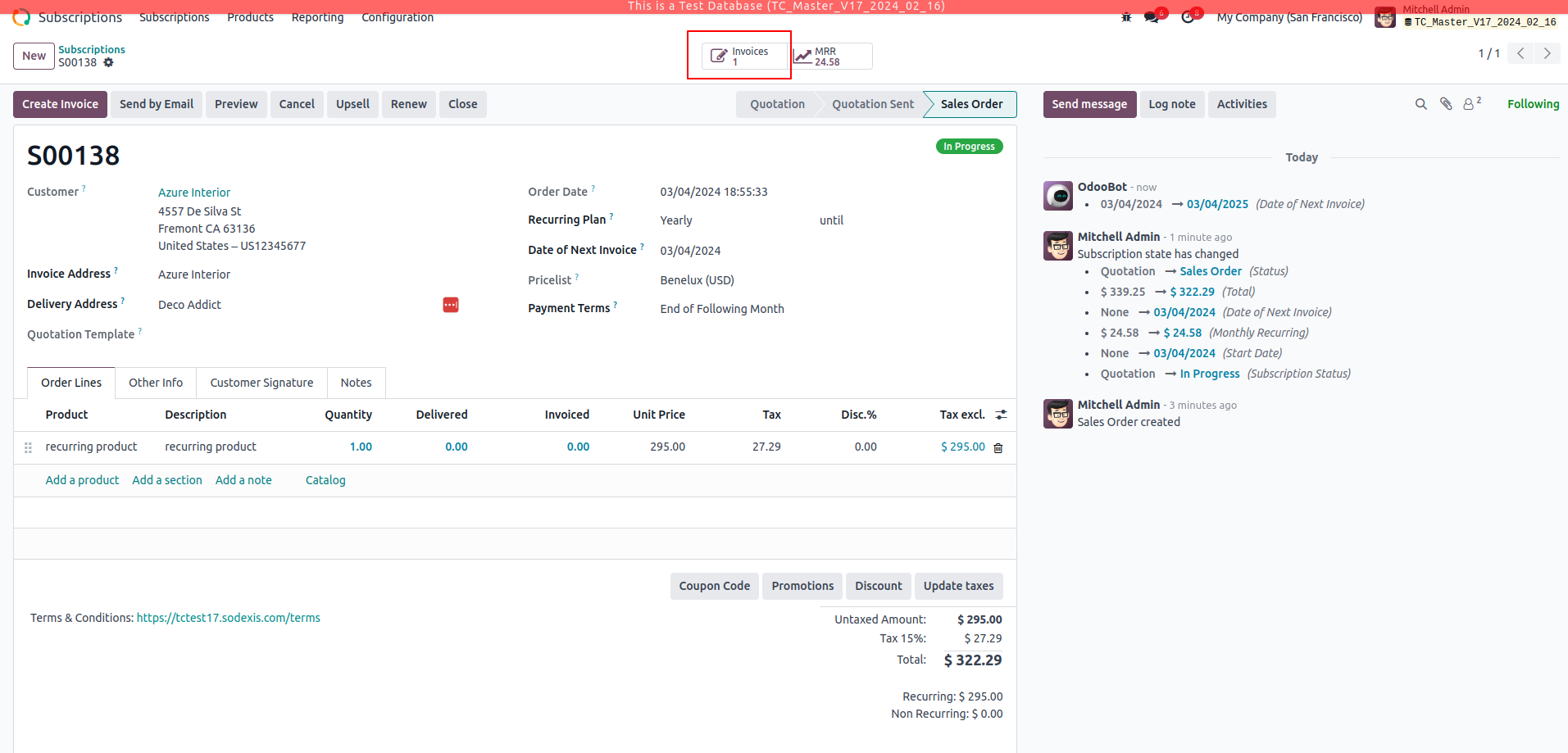

The Invoice is created automatically based on the scheduled action “Sale Subscription: generate recurring invoices and payments”.

This module ensures the tax is computed in the automatic invoice which in turn validates the tax amount.

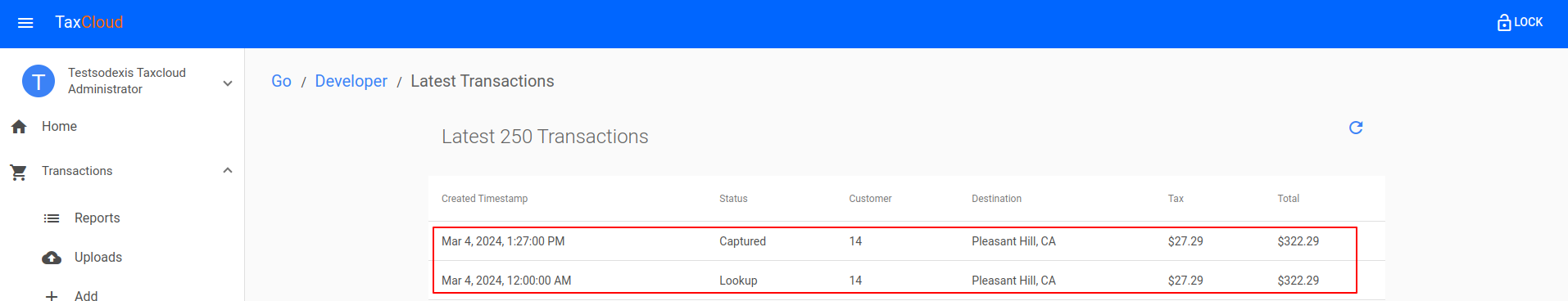

On the TaxCloud website, Go to Transactions - - > Reports which shows the recent transactions in Odoo.

We could see the Status of the Subscription as Lookup and auto Invoice as Captured with the computed Invoice as shown below.

Credits

Contributors

For additional information or inquiries regarding TaxCloud, feel free to reach out to us at Sodexis <📧 taxcloud@sodexis.com >