TaxCloud Integration

Connect Odoo to TaxCloud to calculate and file your sales tax with ease and 100% accuracy. This integration, developed by Sodexis, significantly simplifies sales tax compliance for e-commerce Odoo merchants. Sodexis is also a Certified Integration Partner of TaxCloud.

Key Features & Benefits

Accurate sales tax calculations

Automatically calculate the right sales tax every time in your Odoo store – across all 13,000+ US jurisdictions.

Automated tax filing and reporting

Automate your sales tax filing and remittance and filing and never miss a deadline!

Audit risk protection

Get audit support with an advocate in your corner every step of the way if you’re audited.

Simple sales tax collection

Track your sales on Odoo and across other digital storefronts – and get alerts when you reach economic nexus.

Certified Service Provider for STT

Receive the benefits of SST discounts. TaxCloud is a Certified Service Provider for SST by the Streamlined Sales Tax Governing Board.

Get support via email or phone

Contact Sodexis support in the most convenient way for you with any technical questions.

Odoo Exemption Certificates Simplified

Here’s what’s new:

Exemption Management Module:🆕 Users can now create, manage, and submit exemption certificates directly within Odoo. This feature supports multi-company environments and automatically applies valid exemptions to invoices and credit notes based on the delivery address.

New Functionality and Fields:📋 The update adds new fields to the contact form, such as “Tax Number Type” and “State of Issue,” to help manage exemptions more effectively. Additionally, a new smart button allows users to list all exemption certificates associated with a customer and its related contacts.

Group of States Feature:🌎 Users can now add multiple states at once using a predefined set of states, making the exemption process faster and more efficient.

How to Use the New Features:

Navigate to the Accounting app to find a new “Exemptions” submenu under the Customers menu to manage exemption certificates.

Configure access rights in the Settings app to allow users to create, cancel, and export exemptions to TaxCloud.

Objectives of This Update:

Enhance Compliance and Efficiency: This new capability allows businesses to manage tax exemptions more efficiently, helping them remain compliant with various tax regulations.

Improve User Experience: By allowing merchants to manage exemptions directly in Odoo, we are streamlining their tax management processes and reducing the need for manual handling.

About Sodexis

Sodexis is a leading provider of Open Source ERP and CRM software solutions, serving clients globally with a dedicated team spanning North America and Europe. Comprising passionate professionals, our mission is to enhance and streamline your business operations.

As an Odoo Partner since 2012, we boast a rich history dating back to 2006, delivering proven value to our clients. Our comprehensive services cater to businesses of all sizes, whether you're embarking on an Odoo Implementation or seeking to enhance an existing setup. With extensive expertise and a commitment to excellence, our team is dedicated to delivering optimal results and maximizing your return on investment.

About Odoo

Odoo is the perfect all-in-one business platform for managing your ecommerce business – but there’s just one problem. While Odoo handles everything from accounting to social media, their ecommerce app doesn’t offer integrated sales tax compliance support.

Our TaxCloud integration fixes that by providing you end-to-end sales tax compliance automation for everything from sales tax calculation to sales tax nexus monitoring to worry-free filing – all seamlessly integrated into Odoo. Our TaxCloud integration is the missing piece that every Odoo ecommerce seller needs.

About TaxCloud

TaxCloud offers a cloud-based sales tax compliance platform and hands-on tax filing services to businesses of all sizes. With over 15 years of experience automating sales tax compliance across all 13,000+ US sales tax jurisdictions, TaxCloud ensures you file 100% compliant returns every time.

TaxCloud supports eCommerce businesses with industry-leading sales tax calculation, sales tax collection, sales tax filing, and sales tax audit protection with advanced features like economic nexus alerts, address verification, API access, and detailed return-ready reports

Unlike other sales tax solutions that sell their features separately, you get all tax calculation and collection services for a low monthly or annual price – plus SST discounts. TaxCloud is approved by the Streamlined Sales Tax Governing Board as a Certified Service Provider in all 24 member states, allowing eCommerce businesses to benefit from free services such as support for filing and returns setup, sales tax registration for remote sellers, uniform filing forms, audit support, and more.

Recommended Resources

Sodexis' Odoo integration was built and is maintained in collaboration with TaxCloud to ensure a reliable and easy-to-use integration for Odoo users.

- How to connect my Odoo store to TaxCloud

- How to Connect my TaxCloud Account to Odoo Sale (Loyalty)

- How To Connect my TaxCloud Account to Odoo Sale (Loyalty) - Delivery

- How to Connect my TaxCloud Account to Odoo eCommerce

- How to Connect my TaxCloud Account to Odoo Sale

- How to Connect my TaxCloud Account to Odoo Amazon/TaxCloud Bridge

- How to Connect my TaxCloud Account to Odoo TaxCloud & SubscriptionsFrequentl

Frequently Asked Questions

The app is available for versions V17 and V18. You can find it in the Odoo App Store.

The steps are detailed and explained in the Account TaxCloud Documentation under the Module Installation section.

- Switching from the Odoo TaxCloud module to our connector in odoo V17

- If users are currently using the Odoo TaxCloud module, then they should not uninstall the current module before installing this module; otherwise, they will lose all of their data. This module will take care of the configuration & data transmission from the existing module and automatic uninstallation of the Odoo TaxCloud module once installed. It is not necessary to reinstall the Odoo TaxCloud module.

- Migrating from Odoo 17 to Odoo 18 or from Earlier Versions to Odoo 18

- Migrating from Odoo 17 to Odoo 18

- If user already using our V17 Official Connector then download our V18 Connector from apps store and do the migration like any other third party apps.

- If user Odoo base TaxCloud in V17 then first, switch to the official connector in Odoo 17 to prevent data loss. Then, proceed with the migration to Odoo 18 using our connector.

- Migrating from earlier versions to Odoo 18

- First, migrate to Odoo V17 using our official connector. Then migrate to Odoo 18 to ensure all data is retained.

- Alternatively, the module can be installed directly in Odoo 18 as a fresh installation and configured from scratch.

For help with the TaxCloud module, you can purchase an onboarding package directly from TaxCloud, which includes support from their team. Alternatively, you can purchase a Sodexis Success Pack through this link, which provides additional resources and personalized assistance from our team for installation, setup, and ongoing functionality.

- Once we receive all the required information, including your TaxCloud credentials and answers to the initial onboarding questionnaire, our team typically completes the setup and testing within 5 business days. This includes:

- Install our TaxCloud Connectors in the Staging

- Configuration to Integrate TaxCloud with Staging

- Testing the flow and transaction in TaxCloud

- Assistance with moving the configuration to production

- Once you approve the go-live after completing the above testing in your staging environment, we can move to production within 3 business days.

Our company specializes in consulting, product development, and customer support. We tailor our services to fit the unique needs of businesses across various sectors, helping them grow and succeed in a competitive market.

Customers who are self-hosted or hosted on Odoo.sh can install the modules.

However, it is not compatible with Odoo Online (SaaS) — because Odoo Online does not allow the installation of third-party modules, including the TaxCloud connector

Customers on Odoo Online hosting who are currently on a “minor” version, such as v18.1, would need to downgrade to a stable version like v18.0 and then switch to Odoo.sh hosting before they can install the Sodexis TaxCloud connector (or any other third-party module).

Steps after Migration:

Source code:

Please download and use the V18 version of the TaxCloud apps.

DB Fixes:

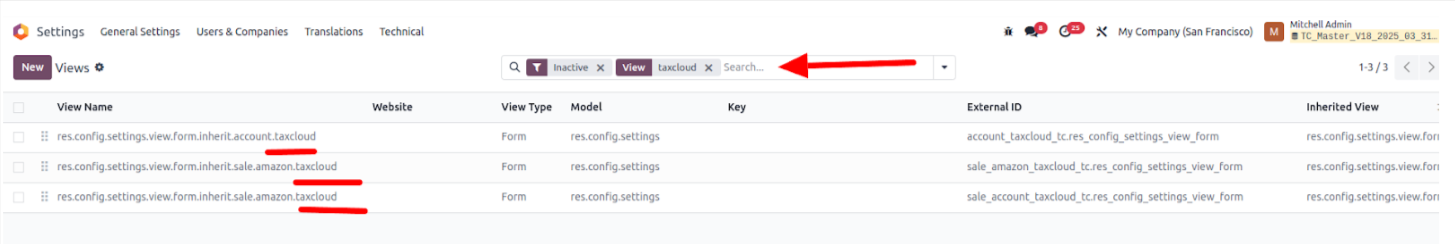

1. In V18, activate the inactive TaxCloud views:

a)Enable Developer Mode.

b)In the "Technical" section (visible only in developer mode), navigate to User Interface → Views.

c)In the search bar at the top of the "Views" list, type "TaxCloud" and apply the Inactive filter.

d)Activate the inactive views.

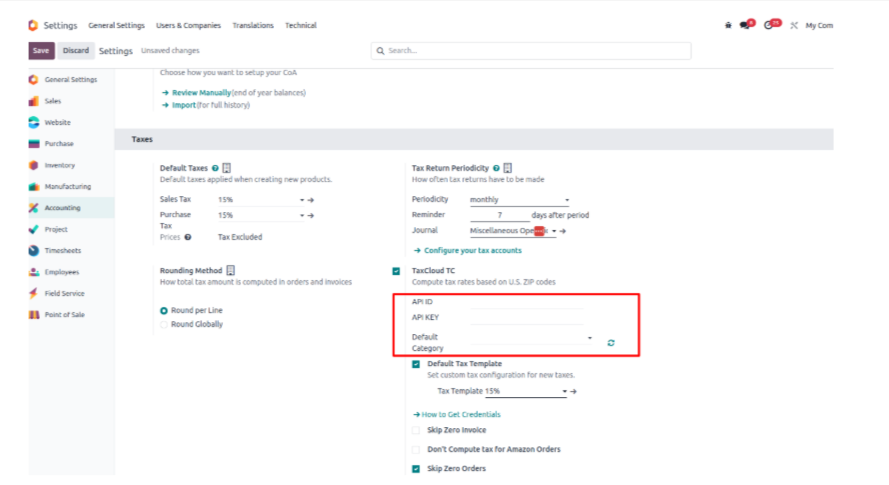

2. In Accounting → Settings, configure the TaxCloud API credentials and set the default category.

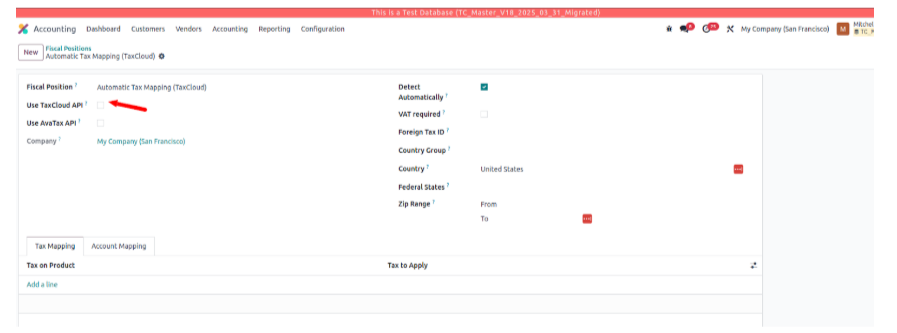

3. Enable the "Use TaxCloud API" boolean in the Fiscal Position, just as in V17.

- Yes, you can cancel the invoice after it’s sent to TaxCloud. If you want to allow invoice cancellation, enable the boolean “Allow Cancel Invoice” option in the Accounting Settings. To enable this feature, make sure you have installed the latest version of the account_taxcloud_tc module which is available from version 17.0.4.0.1.

- This allows canceling invoices only; credit notes are not supported for cancellation with this option.

- Currently, this feature is only available in V17 from version 17.0.4.0.1.

- Regarding the tax rate rounding issues, please note that the tax amount is correct and matches what's calculated by TaxCloud. However, the tax rate % displayed may not be accurate due to rounding, which can cause confusion.

- If this is a concern, we recommend not displaying the tax rate percentage to the customer and instead showing only the total tax amount.

-

We are aligned on a long-term solution to address this issue when we port the integration to TaxCloud APIv3 in the future.

Standalone credit notes in Odoo are not yet integrated with TaxCloud. If this is something you need, please contact us—we’d be happy to explore building a custom connector tailored to your requirements.

It is based on the Delivery Address with the correct Zip code, state, and country.

You need to set up the TaxCloud category on the shipping product.

Yes, it is sent to TaxCloud. If you don’t want to send those, enable the boolean “Skip Zero invoices” or “Skip Zero Orders” option in the Accounting Settings.

Yes. However, if you don’t want to compute tax for sales orders created from Amazon, enable the “Don’t Compute Tax for Amazon Orders” option in Accounting Settings.

Currently, TaxCloud is not integrated with Odoo POS. We're collaborating with TaxCloud to enable this functionality. For the latest updates, feel free to reach out to us.

- A default Tax can be set in the “Default Tax Template” field on the Settings. Once configured, any tax created through the API will use this template. However, fields such as Tax Name, Amount, and Label on Invoices are left to override.

- For the existing taxes, update the account manually or simply archive taxes and API will create new one as per latest enhance we made.

If all the apps are installed properly, check whether the “Use TaxCloud API” boolean is enabled in the fiscal position set on the Sales Order.

Enable the “Detect Automatically” boolean in the Fiscal Position.

No, tax exemption cannot be configured directly in the sales order. There is a separate Exemption menu available in both the Sales and Accounting modules, where you can manage customer tax exemptions.

- Yes, when an exemption is set for the parent contact, it automatically applies to all its child contacts whose delivery state matches the exemption state.

-

However, if an exemption is set for a child contact, it applies only to that contact and does not extend to its parent or child contacts.

Ensure the “Manage TaxCloud Exemption” user group is enabled for the relevant users.

Yes, for some specific TIC codes.

Yes, using the exemption module, a valid exemption certificate that includes a specific exemption reason will ensure the correct tax rate is applied.

To enable tax collection for states, please make sure those states are enabled to collect the taxes in the TaxCloud account.

The threshold is available in the TaxCloud account; there is no configuration for it in Odoo. The threshold will be set automatically.

Yes, this transaction is necessary to maintain consistent tax between the invoice and SO.

This was resolved please make sure you are using the latest version of the app.

The status will be updated as “lookup” for the quotation, “captured” for the invoice, and returned for a credit note. For the confirmed invoice, the transaction is authorized and then captured, so we don’t see the transaction in the authorized state.

- Inability to cancel an Invoice or Credit Note after it has been submitted to TaxCloud.

- Compatibility issues with the Point of Sale (POS) system.

- An "Update Tax" feature on Invoices/Credit Notes to verify the tax amount prior to submission to TaxCloud.

- Odoo sometimes applies discounts using negative line items, which the TaxCloud API does not support at this time.

- The TaxCloud API provides the total amount rather than the tax rate, requiring Odoo to generate the tax rate, which may lead to rounding discrepancies.

- No. TaxCloud now restricts the creation of credit notes with the TaxCloud fiscal position to only those generated from existing invoices. This ensures that all records using the TaxCloud fiscal position are properly reported to TaxCloud.

- We're also rolling out a new release that addresses a bug that previously allowed users to create standalone credit notes with the TaxCloud fiscal position. However, those credit notes weren’t being transmitted to TaxCloud, since TaxCloud only accepts credit notes as reversals of existing, reported invoices.

- To get this update, please download and install the latest version of the TaxCloud connector.

Email taxcloud@sodexis.com for any additional questions or issues.

Check to make sure you're using the most recent version of the Taxcloud connector. If necessary, update the module and try again.

Integration Support

If you need any help with the TaxCloud integration, contact us using the email below. We have a full team of business analysts and developers ready to assist you.

Connect with Sodexis

Contact us to learn more about Odoo and our services. We will be in touch soon to schedule a free.

Sodexis is one call away

Curious how we help with your specific tax challenges? Just call: