How to migrate your Luxembourg accounting plan according to the new PCN 2020

Introduction

The Luxembourg Government introduced a new standardized chart of accounts (known as PCN 2020) in the Grand-Ducal Regulation dated September 12, 2019.

PCN 2020 is a revision of PCN 2009 to match the current needs of both companies and the public sector.

Useful links:

What has changed under PCN 2020?

PCN 2020 is a logical continuation of the 2009 version. However, the nomenclature has been revised as follows:

Some accounts have been:

Added e.g. "211 development costs" has been created;

It means new accounts creation

Deleted e.g. "1821 Provision for corporate income tax" has been deleted;

It means accounts depreciation (or deletion if never used).

Split e.g. “61332 commission and loans’ issuance expenses” has been split into “61332 loans’ issuance expense” and “61338 other banking and similar services”

It means new accounts creation and renaming of existing accounts

Merged e.g. “303 inventories of consumable materials and supplies” combines “302 consumable materials” and “303 consumable supplies”

It means renaming/deprecation of existing accounts (or deletion if never used)

Moved e.g. “22115 developed land” has been moved to “221111 developed land”

It means deprecation of existing accounts and new accounts creation

All changes are available in the official spreadsheet:

How to update the PCN in Odoo?

Deprecate unused accounts

We advise deprecating accounts that have never been used:

It will be easier to compare a reduced 2009 PCN to the 2020 PCN

It saves time, you will avoid analyzing accounts you will never use

It is good practice to prevent erroneous new entries

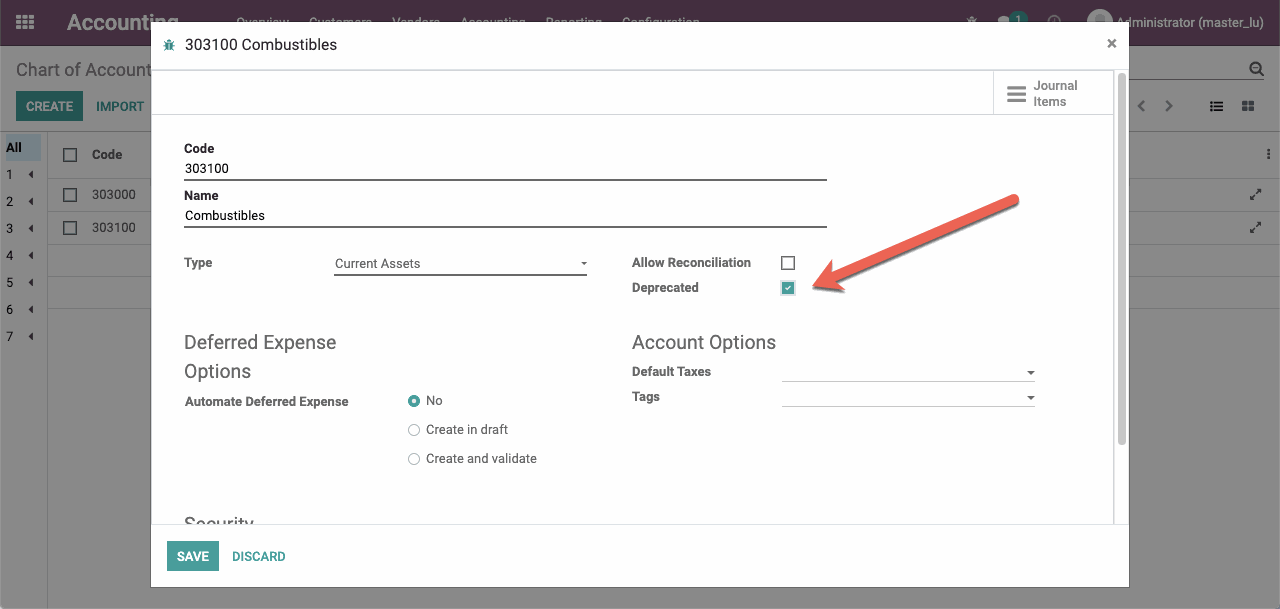

Deprecating one account is easy, you just have to check the “Deprecated” field.

Luxembourgish PCN 2020