Recently, the governments of the Netherlands and Norway decided to increase their lower VAT from 6% to 9% and 10% to 12% respectively.

New installations: When you install the chart of accounts, you will have the latest version installed, including that new tax template and new tax. You shouldn’t be doing anything in particular. It is VERY important to understand that a new installation means:

Having updated the Odoo sources (e.g through a recent pull of Github)

Having installed the accounting package for a company AFTER that pull made in point a. In the opposite situation, if you create a new company before you update your sources, you won’t have that new tax in Odoo’s code, hence, you won’t impact your accounting

Existing installations: In this case, you will need to update manually. Even if you update the localization modules (and the new tax templates might be there), Odoo is not going to update the existing taxes. The data in the localization modules is used for installing a fresh chart of accounts, not for updating accounts/taxes as everyone might have the accounts/taxes configured according to their wishes.

Here is how to update your taxes, in this example, we are using Dutch accounting:

Since you will most likely need the two taxes operating at the same time for a certain time (e.g: to properly invoice December and January). Because of the need for these two taxes at the same time, It’s then MANDATORY to avoid editing the existing tax and prefer duplicating the taxes instead.

How to update for existing installations

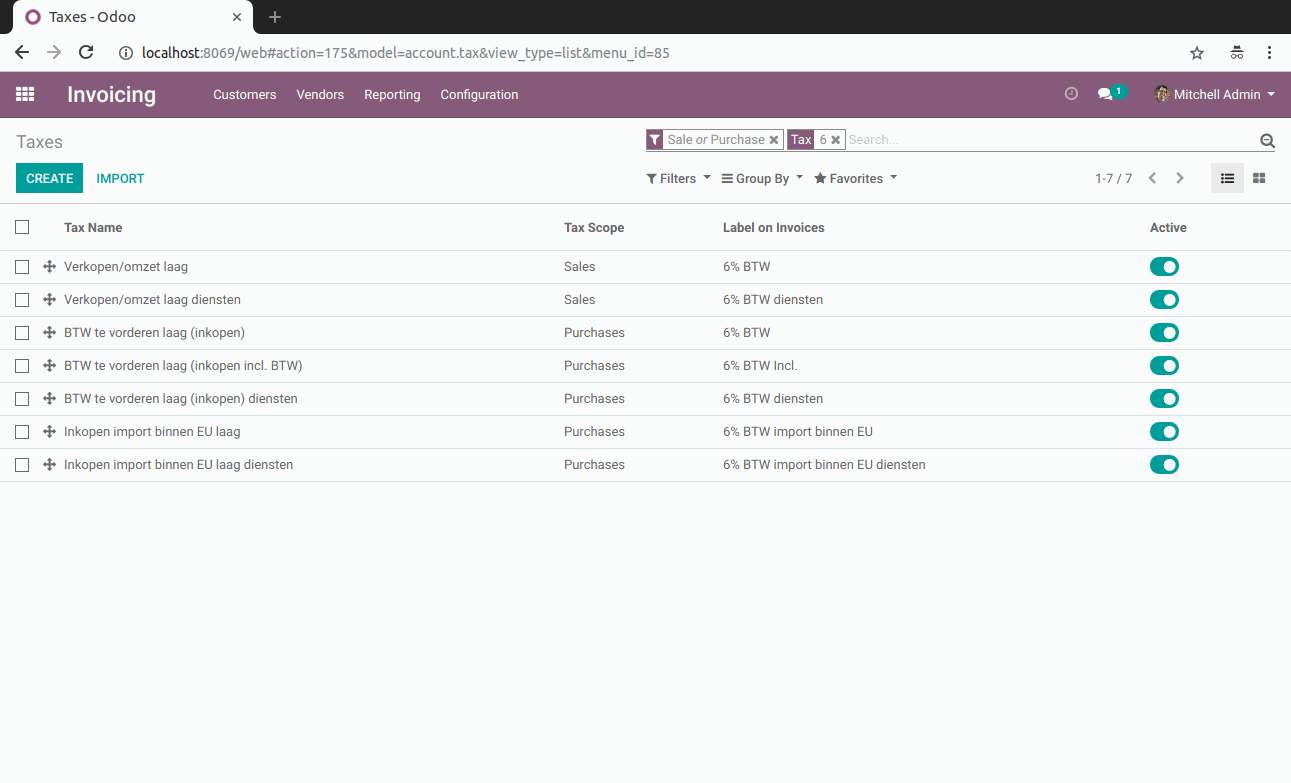

These are the taxes by default in the Dutch localization at 6% that are impacted.

Tax changes in The Netherlands and Norway